Imported from: Google Blogger site

Original publish date: Augist 31, 2017

Digging deeper into bearer and registered bonds

Let's review some critical terms:

Bonds represent loans that investors make TO companies. Bonds are written, binding promises. Companies use bonds to specify the amounts of money they will repay on specific dates. Bonds usually specify interest rates, the schedules of interest payments, and the collateral that companies pledge in case they fail to fulfill their promises. Bondholders are usually 'first in line' in case of corporate bankruptcy. Unless specifically noted, bonds did NOT pay interest after their redemption dates.

Notes are bonds with shorter terms, generally ranging from 6 months to five years. There are a few 'notes' in the railroad database with terms as long as 25 years. Very short-term notes were often issued without coupons. In the article that follows, assume that everything I say about bonds also applies to notes. Unless specifically noted, notes did NOT pay interest after their redemption dates.

Coupons are small demand warrants usually attached to bonds. Coupons are worthless until specific dates, but on those dates, they immediately become payable for interest. Other than their names and small sizes, bond coupons bear no similarity to ordinary coupons that today's retail stores give to their shoppers to entice purchase. Coupons did NOT compound interest after their redemption dates.

Back in July, I wrote about the most obvious differences between registered bonds and coupon bonds. From the 1880s until the 1940s, most medium-and large-sized railroad companies tended to offer both types of bonds whenever they borrowed money. While the differences seem obvious, it is important to understand why companies issued both types. Prior to the 1880s, most companies issued only coupon bonds. After the 1940s, registered bonds became the issuance of choice. The Tax Equity and Fiscal Responsibility Act officially stopped the issuance of domestic bearer bonds in 1982.

In truth, coupon bonds and registered bonds bonds were actually designed to deal with two different features of loans. Registration involved the security of investment principal, whereas coupons dealt with the payment of interest. Viewed from that perspective, registered bonds and coupon bonds were not quite opposites. Let's look at the differences.

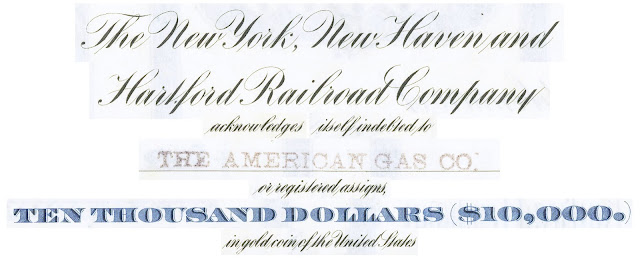

Registered bonds are meant to give security of ownership. Registered bonds are registered in the names of individuals or companies who legally own bonds. Only those specific registered owners are legally entitled to redeem bonds at maturity.

It is important to understand that the true opposites of registered bonds are not coupon bonds, per se, but bearer bonds.

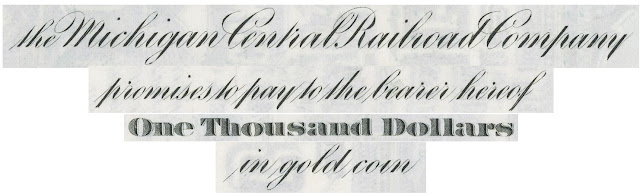

Bearer bonds represent no specific ownership. They are not secure. Whoever possesses bearer bonds can redeem them. There is no implied concern about whether ownership is legal. The differences between registered bonds and bearer bonds represent the differences in who will receive funds at the time of redemption.

Having said that, we must question who is entitled to receive interest payments in the period between purchase and redemption. Legal owners or bearers? Who should be responsible for initiating interest payments? Companies or bondholders? Is interest going to be paid throughout the terms of bonds? Or is interest going to be allowed to accumulate until the time of redemption?

These questions give rise to different approaches and this is where coupons come in.

Coupon bonds push the responsibility for collecting interest to bondholders. Whoever possesses coupon bonds must purposely redeem their coupons for interest, usually twice per year. If bondholders lose coupons or wait a long time before cashing them in, the problem is theirs alone. Viewed from the perspectives of companies, every lost or non-redeemed coupon represents profit.

With rare exception, coupons are bearer instruments. That means that whoever possesses coupons may redeem them. Legal ownership is a matter of concern for the legal system, not for companies.

The vast majority of corporate bearer bonds were issued with coupons, hence the reason that 'bearer bonds' are almost synonymous with 'coupon bonds.'

Bonds issued without coupons. The vast majority of registered railroad bonds were issued without coupons. In most cases, companies would have paid interest on registered bonds only to registered owners.

There is a question, however, whether all companies assumed the responsibility for sending interest payments to bondholders. Did some wait until bondholders requested payments? The text on registered bonds is rarely explicit on this point. Most registered bonds merely say they would make payments at the office of the railroad company or at the office of its agents. Theoretically, bondholders would have been paid through their brokerage accounts, but looking through the lens of time, it is unclear who was responsible for initiating those payments.

It is also important to understand that not all registered bonds were issued without coupons. Some registered bonds were, in fact, issued with coupons. Registered coupon bonds are fairly common among U.S. Treasury bonds, but they are quite rare among collectible railroad bonds. For those reasons, it is easy to understand why most collectors – and many companies – considered registered bonds the opposites of coupon bonds.

As I hinted above, companies and investors might prefer a third method for paying and collecting interest. What if interest is not paid during the terms of loans? What if interest is paid only at the time that companies redeem their bonds?

This is, in fact, the method the U.S. Government uses to pay interest on its savings bonds and short term Treasury Bills. While used more frequently in later years, some very early railroad companies took this approach, too.

Such bonds are issued without coupons and are usually called zero-coupon bonds or 'zeros.' Interest is paid only upon final redemption. Some zero-coupon bonds are sold at face value and allow interest to accumulate over the terms of loans. Interest is not paid periodically, but only when bonds are redeemed. For example, companies will need to pay investors $1,500 each to retire 10-yr, 5%, $1000 bonds. (5% interest on $1000 is $50/year; over ten years, delayed interest payments total $500. In this scenario, interest does not compound.)

Instead of accumulating interest over long periods, companies generally prefer to repay only the face value of zero-coupon bonds at the time of redemption. Consequently, investors must build in their own desired interest rate by purchasing zero-coupon bonds at discounts from face values. For instance, investors willing to settle for 5% non-compounding yield on their money will pay no more than $666 for a 10-year, $1000 bond. (If investors want their money to compound, they will probably lower their offers to less than $614.)

Both kinds of zero-coupon bonds are known among railroad bonds.

How are bonds distinguished in my database? Up until now, I have usually described bonds as either coupon bonds or registered bonds. I recently examined all 8,400 bonds in my database and pushed as many as possible into slightly more elaborate categories. The vast majority are described as:

- bearer coupon bonds

- registered bonds (typical bonds issued without coupons)

Long-time readers will notice a few new descriptive categories when I had enough information to determine their types:

- bearer zero-coupon bonds

- registered coupon bonds

- registered zero-coupon bonds

(Don't freak out! There aren't many bonds in these new categories.)

How did I decide whether a bond started life as a bearer or a registered instrument? The key lies in simple, two-word phrases that appear on most bonds:

- ... 'or bearer' ...

- ... 'or holder' ...

- ... 'or assigns' ...

- ... 'or order' ...

Bearer bonds are the easiest to recognize. A large number were simply issued 'to bearer.' Most bearer bonds, however, have text that shows that bonds were initially issued to companies or prominent individuals followed by the phrase, 'or bearer.' A few companies used the phrase 'or holder,' but the meanings appear to have been entirely synonymous.

Because bonds were commonly written for terms of thirty to well over a hundred years, companies always assumed that bondholders would change through time. Consequently, we can understand the need for phrases like 'or bearer.' While 'or bearer' is not always obvious, some variation can usually be found somewhere on every bond that once had coupons attached.

By contrast, the vast majority of registered bonds left an empty space or line for bondholders' names, followed by the phrase, 'or assigns.' Legally, the word 'assigns' means 'assignees,' and carries the implication of legal transference of all rights.

I personally doubt that assigns was always interpreted using today's meaning.

To complicate matters further, some companies used the phrase 'or order' in place of 'or assigns.' According to current legal definitions, if a document is payable to an identified person 'or order,' it is not payable to a bearer. (See Legal Information Institute at the Cornell Law School.) Consequently, I define 'or order' like 'or assigns.' That does not mean I believe the definition was always accepted that way, nor that every company used the phrase in the same manner.

One final point. Although investors usually had justifiable preferences for one format over the other, they could later change their minds. They could register their bearer bonds or they could trade their registered bonds for bearer bonds at any time. My next blog article will discuss the flexibility of bonds types.