Cataloging countries, states, and companies are strictly secondary goals that aid the primary purpose of this project.

Definitions change through time, "security" among them. Another favorite historical explanation for the word "security" comes from Benjamin Schak. It is viewable on Quora. In effect Schak suggests:

- in the 15th century, "security" meant property pledged to guarantee some debt or promise

- starting in 17th century, "securities" meant documents evidencing debts, which ultimately morphed into documents representing financial investments

- by the late 19th century, "securities" meant tradeable investments, not necessarily collateralized

FUNGIBILITY is an important concept relative to the definition of "securities," but defining it is better left to sources such as Investopedia.com. When ready to "jump into the weeds," see a robust discussion there on the concept of "fungibility."

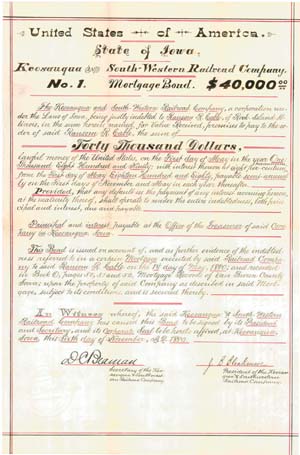

Stocks and bonds are legal documents. Stocks represent deeds to undivided ownership rights in companies. Bonds represent agreements made by companies to repay borrowed money. Even if entirely handwritten (like the example at left), such documents are entirely legal. Therefore, this project catalogs handwritten stocks and bonds exactly like all others.

Handwritten company names on secondary certificates

This project ignores most handwritten and partially printed non‑security documents with handwritten company names. Further explanation below.

I also catalog many types of ancillary certificates

Railroad companies produced many different kinds of documents to facilitate the sales, trading, and functioning of stocks and bonds. Some of those documents were tradable and functioned as valid securities including:

- temporary or interim stock certificates

- temporary or interim bonds

- various trust certificates

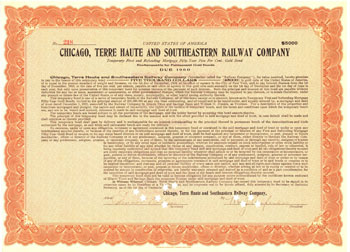

A large number of highly variable documents, primarily receipts, played roles that could have been construed as "potential" securities under specific and limited circumstances. For instance, stock and bond purchases were often evidenced by receipts testifying to full or partial payments with delivery promised at some future date. Had those securities never arrived, the receipts could have been used as proof of purchase and therefore were every bit as valid as the securities they represented. (Temporary bond shown at right courtesy of Hollins Certificates.)

In a similar fashion, transfer receipts could also have served as proof of ownership of shares or bonds and again were equally valid to insure replacement in case of loss.

Yet another very large group of ancillary documents included stock scrip and bond scrip normally denominated in currency. All were conditionally convertible into full-fledged securities once a sufficient amount had been accumulated. Since most scrip certificates were bearer instruments, they could have been bought and sold and therefore could have been declared "fungible."

This project catalogs well over 200 kinds of secondary security-related documents as long as they indicate:

- direct proof of ownership of securities

- partial payment on securities

- commitment to purchase securities

- demand for payment under commitments to purchase securities

- potential conversion into genuine securities

- payment or interest or dividends due to the ownership of securities

- transfer of securities

- deposit of securities with trustees

AND

- they are printed documents that display printed company names. (Yes, non-security documents with handwritten company names were and may remain equally legal, but I generally choose to ignore them in this project.)

Why do I ignore non-security documents with handwritten company names?

While most of these ephemeral, ancillary documents have been discarded, there could potentially be thousands of handwritten, typed, and partially-printed forms used by brokers over the past 150 years. Many are now unique. Most are low value and largely rejected by collectors. I must prevent exponential growth in the size of this project, so I specifically exclude:

- handwritten or typewritten non-security documents

- generic forms that do not display printed corporate railroad company names

I ask collectors to understand that there have been countless thousands of securities brokers across North America. Their business was to facilitate the trading and transfer of securities among investors. They recorded transfers and day-to-day sales of securities on pre-printed receipts and they would fill in company names by hand. Those same forms could have been used for any number or types of companies and brokers dealt in all sorts of companies, not just railroads. Successful brokers might have transferred tens or hundreds of securities in a day. Forms may have been changed with each printing. While most such receipts were ephemeral and disappeared as quickly as they appeared, some still exist. I recognize that they are collectible, but they tend to be very low value. I do not catalog those kinds of documents because:

- most documents without printed company names were merely documents printed by brokers and banks

- they were NOT securities

- they were NOT printed by railroad companies

- including them would increase the size of this project too much

- they are commonly ignored by stock and bond collectors.

I really hope collectors will appreicate my dillema. A transfer printed by an ordinary broker might have been used for any number of railroad companies. And yet, very few brokers ever printed their own names on their documents. I would, therefore, need to catalog the very same document under multiple companies. I guess I could group documents with handwritten company names under one large "generic broker documents" category. I'm not sure that would be terribly helpful either. And what do I do about estimating prices when they rarely sell for more than a few dollars apiece? I suppose I could estimate all their prices at $5 apiece and let the market sort things out.

None of these alternatives seem like they would help advance the hobby. After all, the overwhelming majority of collectors focus on collecting full-fledged stocks and bonds.

Other non-cataloged, off-topic documents

I specifically exclude documents which never could have been called securities:

- powers of attorney

- proxy forms

- general company communications

- corporate contracts

- ordinary business documents

- invoices to or from railroad companies

- company currency meant to circulate among the general public

- documents related to the carriage of passengers of freight, including tickets and passes

- railroad schedules

- line maps, route maps

- tourism-related brochures and phto albums

- picture postcards

- items postmarked by RPOs (Railway Post Office

- corporate or general interest rail-related magazines

- county railroad tax receipts unless there is explicit mention of direct benefit to or from railroad companies