Selling collections to professional dealers

Dealers need to buy collections

It is important to appreciate that professional dealers need to buy collections. They attract loyal and experienced collectors who are always in the market for new, different, and scarce certificates. Dealers participate in auctions like everyone else, but they must buy with an eye on making a profits when they re-sell. Consequently, collectors have an edge on dealers when buying at auction. Collectors frequently end up purchasing excellent and rare items at prices higher than dealers can pay. Collectors commonly hold onto such items for decades. When it comes time for collectors to liquidate, dealers love to have chances to buy direct from collectors without needing to pay auction commissions.

What kinds of collections do dealers buy?

While it is true that dealers need to buy, that doesn't mean they need to buy every day and it doesn't mean they need to buy every collection of every item offered.

Dealers come in all different sizes, with widely different specialties. Some have large inventories. Some small. Some have available cash, Some don't. Chances are, there is a dealer out there to match just about any size of collection in any specialty.

Unfortunately, the need to buy ebbs and flows with the seasons, collector sentiment, world affairs, and personal situations. Catching the right dealer at the right time with the right collection is somewhat a matter of luck.

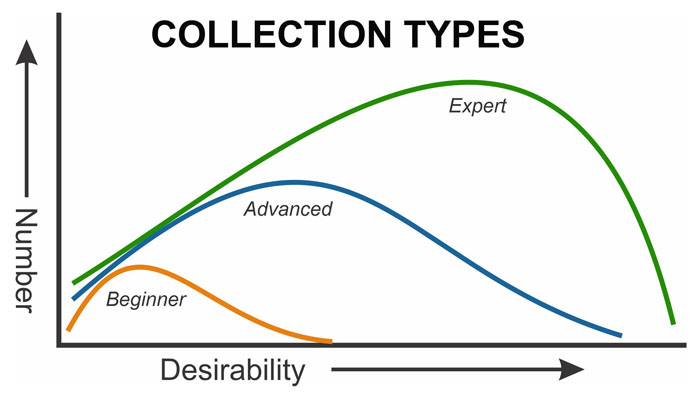

As a rule, dealer inventories are already heavy with common, beginner material. They may have held quantities of those kinds of certificates for years. Selling those items became terribly difficult once eBay secured a death grip on beginner-style collectibles. Dealers, especially dealers with large inventories, can rarely afford to pay anything for items they have in abundance. They will, on the other hand, pay more for scarce items they can re-sell within days or weeks.

Smaller dealers usually have lower overhead, advertising, storage, and transaction costs. They can sometimes purchase entry-level items more profitably. Conversely, they may not have the funds to buy high-ticket collections and nor may they have ready buyers standing on the sidelines.

The point is that there is probably a buyer out there for most collections. Or maybe two or three if collections are highly diverse. It will be up to the sellers to find them. Just because a dealer says "No" today, does not reflect any ill will toward collectors or collections. It reflects their business strategies and existing inventories. Moreover, a "No" today does not necessarily mean a "No" forever.

Dealers' purchasing characteristics

Professional dealers cannot exist with bad reputations, so they tend to pay quickly. Certainly faster than auction houses. That does not mean they are always ready to buy collections all the time. If they recently dented their bank accounts with large purchases, they may not want to spend more until they recoup some of their recent outlays. If dealers slow-walk purchasing a collection or making offers, they may be trying to buy time. When collectors are in a hurry to sell, they need to say so. If they are not in a rush, they should say that, too.

Valuing collections

Dealers do not usually make offers sight-unseen. They want to see what they are buying.

Dealers may travel if collections are large and enticing. Collectors with small to mid-size collections should plan on sending certificates by registered and insured mail. Collectors who have already scanned and inventoried their collections will have a head start with most dealers. I still suggest to plan on packaging and sending complete collections so dealers can see in person.

Some collectors might want to send spreadsheets or lists of certificates they own. I cannot speak for dealers, but suspect they prefer to see images of individual certificates rather then lists in Excel files. Scanned images or photographs of individual certificates would probably be acceptable, but file sizes need to be small and manageable. Shipping the collection for inspection might be the most expedient method. Ask prospective dealers their preferences.

If dealers are truly interested, most will make offers fairly quickly. Many have been in the business for twenty, thirty, or forty years and have "seen it all." Most know what they are buying and know what they can sell. If they are reluctant to offer, or make low-ball offers, they know they will need to "sit on" your certificates for a long time. If they make quick offers, they are telling you in no uncertain terms that they have collectors they can contact tomorrow.

I strongly advise collectors to avoid getting greedy. Initial offers may seem low. Collectors might successfully get a little more by asking. Conversely, the first offer might be the highest and best offer. It is always possible that dealers will get cold feet after initial offers are rejected , in which case they simply elect to withdraw their offers entirely. It is up to the collector to know when to negotiate and when to capitulate.

I suggest it is never wise to burn a bridge if an initial offer seems offensively low. A more sensible approach is to ask if there might be a better time to revisit the offer later. Remember, most dealers have been negotiating on purchases for years and selling collectibles is a highly flexible endeavor. Today's offer might seem crazy low today or crazy high tomorrow. Just as collectors' lives change day to day, so do dealers'.

Consignment selling may not be out of the question

There might be a dealer with a perfect customer base for a collector's certificates, but the dealer might not be in a position to buy an entire collection. If a collector is not in a hurry to sell, it might be good for both parties to sell on a consignment basis. Simply ask.

NEVER ask dealers to make per-item offers

Every dealer alive has made buying mistakes. Purchasing mistakes are paying too much and offering too little. Mistakes happen all the time. Buying many items at one time often allows high and low mistakes to offset each other. In the ever-changing business of collectibles, the only way to soften purchasing mistakes to make offers for larger numbers of items. When collectors ask for offers on single items, they are effectively asking buyers to make mistakes only on the high side. I don't know a single dealer who enjoys single-item offers.

What if dealers WANT to make offers on smaller groups?

This is the reverse situation. If buyers make offers on select parts of collections, they are effectively asking sellers to piecemeal their assets. I consider this eventuality a very difficult problem. Selling off better material first might leave the remainder unsalable or salable only at "fire sale" prices.

Conversely, if a collector could find a buyer for low-value certificates, it might make the rest of the collection more salable.

As mentioned previously, dealers have been negotiating on collectibles for a long time and they know how the business works. They are not in the business of taking advantage of innocents, but they know what they want. Collectors can counter by being prepared. They need to look at their collections realistically before they begin their liquidation process.

Are collections heavy on common and beginner-level certificates? Are they composed of bunches of mid-level and higher-priced scarcities? Once they have a clear view of what collections will look like to professional dealers, collectors can form their own liquidation strategies. Sometimes it might be wise to sell beginner material first. Sometimes it might be wise to sell different parts of collections to different types of dealers. Sometimes selling whole collections to one dealer at one time gets rid of the liquidation problem with the least amount of pain.