Stock certificate terminology

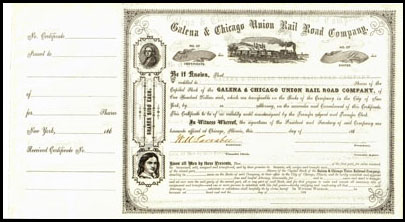

Appearances

Collectors will see substantial variation in the sizes of stock certificates although they are generally about 10 to 12 inches wide by 7 to 9 inches tall. Size varied from company to company and from time to time. Some certificates were as small as today’s paper money while others were as large as supermarket tabloids.

Assessable and non-assessable stocks

Early stocks were assessable. That meant companies could assess stockholders for additional funds if they ran into financial trouble. It was not uncommon for shaky companies to request additional funds from stockholders several times before ultimate failure. Investors of limited means could ill afford the luxury of owning assessable stock. Companies often enticed investors to buy assessable stock by selling shares for fractions of stated par values. Many, many examples exist of companies which were officially capitalized for $50 per share, but which sold their initial shares for 10% down. At $5 per share, average, middle class citizens could 'invest' in up-and-coming railroads, often buying more shares than they could otherwise have afforded.

Needing to avoid financial surprises, investors eventually drifted away from assessable stocks. In response to diminishing stock sales, companies tried to discover new ways to keep their stocks attractive as investments. An article in the Sep. 23, 1918 issue of Investment Weekly (pg. 18) claimed, "There is no such thing as an assessable railroad stock." A rubber stamp impression on stock certificates of the Gary & Interurban Railroad dated as late as 1915 suggests that contention might not have been entirely true.

Regardless, essentially all companies ultimately made their certificates non-assessable, and that designation remained on many late-date certificates.

Bearer certificates versus registered certificates

Only a tiny number of North American stock certificates were bearer stocks. Whoever held the stock was considered to be the legitimate owner, no matter how certificates were obtained. The remainder were registered shares, meaning companies kept records of investors who owned stock. Those "records," (such as the were) often appear on the stubs of stock certificates and less frequently in the pages of the few surviving stock journals.

Capital or corporate stock

The terms capital and corporate stock represent the total issuance of all stock. In practice, most companies issued only one kind of stock, so the terms common, corporate, ordinary, and capital stock are usually synonymous.

Capitalization amounts

The capitalization value of a company is the stated number of shares authorized by the state where incorporated times per-share par value. Capitalization amount frequently appeared on early certificates but the practice gradually disappeared over time. In many cases, printed capitalization values were altered either higher or lower as the authorized share issuance or par value changed. In most cases, changes were made by hand, rubber stamp, and overprinting. Occasionally, capitalization changes appeared on gold or silver foil applied over earlier values.

The most extreme printed example of ever-increasing capitalizations is found on certificates of the Little Miami Rail Road. That company kept a stable $50 par value, but increased its capitalization eight times between 1844 and 1896. Four of those increases were memorialized by overprinting on gold foil applied to the left sides of certificates

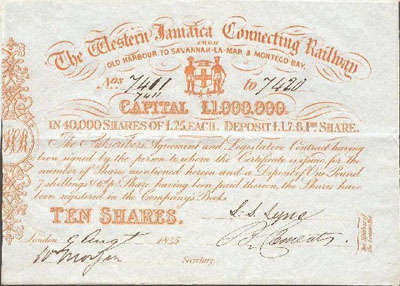

Color

One-color black printing was the standard for many decades. Red ink appeared on certificates as early as 1837 although it was never popular. Brown borders put in an appearance in the mid-1840s followed by green in the 1850s. Green ultimately became the second most popular border color, probably because green was so closely associated with banknotes.

It seems every imaginable combination of ink colors was used. Many of those colors are hard to describe. This project describes certificates with very ordinary terms and purposely avoids finer color descriptions common to the stamp hobby.

While it was customary to use different colors for different denominations (and the New York Stock Exchange dictated such for its listed securities), there is no apparent relationship of colors to denominations between companies. On the other hand, there seems to be a slight preference for using red to differentiate preferred certificates from common certificates.

Common and preferred classes

Investors have always had widely variable motives for buying stock in companies. Some investors wanted predictable income in the form of dividends. Others speculated that the value of their shares would rise and they could make profits by re-selling their shares at later times. To accommodate investor motives, company executives developed two main sub-classes of capital stock: common and preferred. Taken together, both are generically referred to as capital stock.

Generally, only the most secure companies issued preferred stock. Consequently, common stocks are about five times more plentiful than preferred stocks. In general, collectors pay the same for both types.

Convertible stocks

Collectors will occasionally encounter convertible preferred stock certificates. Provisions allowed owners to convert preferred shares into common shares under certain conditions.

Denominations

Over 70% of all stock certificate varieties recorded in this project are classified as odd-share denominations. In other words, certificates could have been used to represent the ownership of any number of shares. The second and third most-used denominations were "100 shares" and "less than 100 shares" at 11% each. All other denominations are greatly less represented.

In general, 100-share and <100-share denominations were used primarily by large companies. Since there were more large railroads than large coal companies, those denominations were more popular among railroads. For example:

Percentage of stock certificate varieties recorded by denomination

| Denominations |

Rail |

Coal |

| odd-share |

69% |

83% |

| <100-share |

11% |

6% |

| 100-share |

12% |

6% |

| all others |

8% |

5% |

Dividends

Early rail ventures were extremely risky. In order to entice investment, developers offered to share potential profits with investors in proportion to the number of shares investors owned. Equally divided profits are called dividends.

Dividends from common stocks

Most investors buy common stock. IF companies offer dividends, stockholders of common shares have direct stakes in their companies’ fortunes. Profits are unpredictable, so dividends are usually unpredictable. Some years, dividends are high. Some years, there are no dividends at all.

Additionally, common stockholders are allowed to vote on directors and certain business issues during annual meetings.

Dividends from preferred stocks

By contrast, dividends for preferred stocks theoretically remain the same from year to year. When companies pay annual dividends, they give preferred treatment to stockholders of preferred stock. They pay preferred stockholders first, and if there is any money left, they pay dividends to common stockholders. Additionally, in the case of bankruptcy and liquidation of companies, preferred stock receive funds (if any) before common stockholders.

Since preferred stockholders receive predictable dividends, they do not directly benefit when company profits rise. Nor do all have voting rights. In those respects, "preferred" does not necessarily mean "better."

Larger companies often issued sub-classes of preferred stock with internal pecking orders in the distribution of both the amounts and priorities of dividends. Typical sub-classes include first preferred, second preferred, and prior preferred.

Employee stock

Companies have often been more successful at selling non-voting classes of stock to their employees. Companies often impose extreme limitations on employees selling their corporate shares, so extremely few non-voting certificates survive on the collectibles market.

Format

With rare exceptions, North American stock certificates were printed in horizontal format. That means the text is printed across the wide dimension of the paper.

Par value

This was originally the theoretical value that companies sold (or wanted to sell) their shares for. There are a sufficient number of old stock receipts in the collectibles market to suggest par was a precisely what shares sold for in the early to mid 1800s. Unless, of course, those receipts were faked.

Redemption qualifications are cited on much stock scrip, and that text strongly implies that companies sold shares to their scrip holders for par, essentially turning stock dividends into more shares. (Unless those too were faked!)

It is also clear that once stock certificates were in the open market and traded between investors that market prices for common and capital stock rarely matched par value. (Market price for preferred stock roughly orbited around par value, but for different reasons.) It it does not take long examination of the financial sections in old newspapers to see there was never any static relationship between par and market prices.

"No-par" stock came into vogue in the 1880s and 1890s primarily as a way to overcome a sticky issue of stockholder liability. If a company issued stock with a $100 per share par value, but sold it for less, then stockholders were liable for the difference in cases of lawsuits brought by creditors. (See "Limited Liability in Historical Perspective", Frederick G. Kempin, Jr., American Business Law Association Bulletin, vol 4, no. 1, March, 1960.)

Primarily because of stockholder liability issues, the meaning and levels of stock par value has changed over time and is now (generally) a minor accounting term. Collectors are advised to consult Investopedia and other financial references for discussions of par value.

$100 par values appear on two-thirds (66%) of all recorded certificate varieties. Another 20% show par values of $50. The remainder show a large variety of par in several currencies.

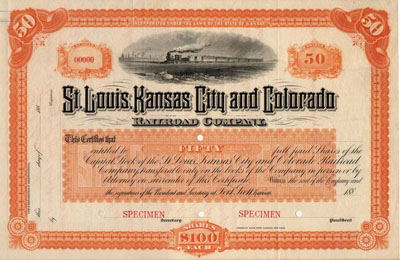

Punch panels

As evidenced by the numbers of "raised" banknotes that circulated before the Civil War, it must have been relatively easy to remove or alter handwritten share values and substitute higher numbers. To foil the practice, engravers added numbered panels that were meant to be punched upon issuance to verify odd numbers of shares. The majority of panels held two-columns of numbers (1 through 0) that could validate up to 99 shares. Panels were customarily placed within or over the right border. A smaller number of instances are known where numbers were placed in bottom borders and those generally verified ranges of numbers of shares instead of precise numbers.

Recent certificates

Most companies have stopped issuing paper certificates in favor of electronic transactions. Paper stock certificates are almost extinct among operating companies. You may still buy paper certificates from a very few companies, but expect to pay $50 to $75 for the luxury – in addition to the cost of the underlying shares.

Serial numbers

All but a few legally-issued stock certificates show serial numbers. A few very early certificates show "re-used" or "recycled" serial numbers when shares were re-issued after transfer. Some such recycled numbers display prefix or suffix letters.

Larger companies learned quickly that having clerks write serial numbers by hand caused problems, both with questionable writing and the cost of labor. Handwritten serial numbers persisted until the last gasp of paper certificates, but pre-printed serial numbering has been seen as early as the 1830s. Some varieties of great longevity (the Baltimore & Ohio in particular) span changeovers from handwritten to pre-printed forms.

Medallions for serial numbers and shares

Most stock certificates display medallions, boxes or lines for holding serial numbers and numbers of shares. There is no standardized location, but the vast majority of serial numbers in the upper left quadrant with shares placed at the upper right.

"Stock certificates" versus "share certificates"

American collectors tend to call them stock certificates while European collectors prefer the term share certificates.

Stubs

Printing companies usually delivered new stock certificates in 'stock books' of 100 or 200 certificates, bound on the left sides of certificates. As certificates were issued, clerks records the names of stockholders, dates and numbers of shares on both the certificates and the stubs. Certificates were usually cut out of the stock books with scissors. Perforations seem to have appear in the 1880s.

Wording

The words stock and share appear on almost all stock certificates. Most certificates display text similar to:

This is to certify that _________________ is the owner of _______ shares of the capital stock of the NEW YORK CENTRAL RAILROAD COMPANY...

By convention, the number of shares was written in text form as protection against alteration. Many late-date certificates issued in the 1970s and 1980s show computer-printed numbers of shares in a five-line pattern of repetitive numbers and asterisks.

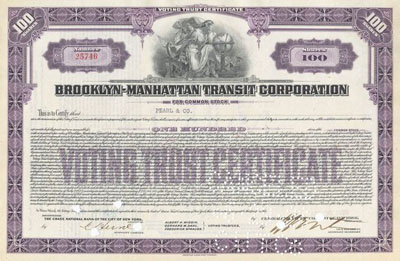

Voting and non-voting classes

Occasionally stockholders’ opinions were at odds with company executives who wanted to retain tight control over how they ran their companies. Around the turn of the century, railroad executives devised ways to decrease the interference of pesky investors. In some companies, boards of directors sub-divided both common and preferred stocks into voting and non-voting classes. Investors generally want to feel like they can influence their companies, so they have always been reluctant to buy non-voting stock shares. Companies try to entice purchase by promising higher dividends or other favorable features. In general, only well-run, profitable companies have successfully sold non-voting classes of stock.

Voting trust certificates

Collectors will frequently encounter certificates that appear to be ordinary stock certificates, but which are labeled "voting trust certificates." Corporations on the verge of failure often needed to make far-reaching decisions very quickly. That was difficult if companies needed to solicit votes from hundreds or thousands of stockholders. To streamline voting during perilous financial times, companies (and frequently investors with opposing motivations) often formed 'voting trusts' composed of small groups of knowledgeable decision makers. Some were initiated under court order but many during the 1890s were formed to consolidate numerous companies in financial peril into larger, hopefully more corporations. This meant that ordinary shareholders needed to "trust" those decision makers to make good decisions.

Voting trusts were related to companies, but were actually separate entities. They generally printed special certificates and temporarily traded them to stockholders for ordinary shares. If those trusts successfully rescued companies from bankruptcy or were successful in consolidation and merger, they returned ordinary stock certificates to their rightful owners or traded them for shares in new companies.