Price

PRICE is one of the great drivers of collecting hobbies. Whether it is the most concerning factor during acquisition or the one most hoped-for at disposition, price is always in the conversation.

Yes, a meager handful of uncancelled bonds might retain value as securities. Possibly ,even a few stock certificates might hold value if the current holder can prove legal title. But please understand that normal collectible certificates have no inherent value whatsoever. They are sheets of paper, nothing more.

When hobby participants bandy about the word "value," they are really talking about "collector value." Collector value is what the next buyer might be willing to pay for something. Certificates lack fundamental or widely-agreed values, so collector values are wildly variable. One collector might value a certificate at $100 while another might offer $5 and say. "Take it or leave it."

Using the word "value" when talking about certificates causes serious problems of misinterpretation to people outside the hobby. Using the word "value" creates an impression that there will always be a floor price, a price below which an item would never sell.

Let's say gold were currently valued at $1,800 per ounce on the world market, No one would ever expect the price to be $1,000 tomorrow. There are too many potential gold buyers willing to pay something close to $1,800.

Conversely, a certificate with a "collector value" of $1,800 today might not be able to attract buyers willing to pay $1,000 tomorrow. Yes, there are probably buyers out there somewhere willing to pay $1,800. The question is how long a seller might need to wait before finding buyer.

Like beauty, collector value is "in the eye of the beholder." We do not know the motivations that will drive future buyers. We don't know anything about their bank accounts. We don't really know what they might be willing to pay

What we can do is learn what other collectors have been paying for similar certificates. If we gather sufficient information, we can predict with some degree of reliability, what collectors should be willing to pay tomorrow. It is important for collectors to accept that there is no set value for any collectible. That is why this project tries to avoid the word "value" as much as possible.

Throw a 1,000-ounce bar of gold into the gold market and there will be huge numbers of potential buyers. Offer an 1856 Baltimore & Ohio stock certificate on eBay and within a week, there will be several buyers willing to pay $25. Offer that same certificate at $35 and fewer bidders will step up. Professional dealers can usually sell for more than eBay prices because they display bright, clear images and offer rock-solid guarantees. We will never know how buyers might value a rare certificate, but we can certainly predict the prices they will pay for commodity-like items. Predictions become increasingly difficult the further we move into the realm of "hard-to-find," "scarce" and "rare."

So what do collector prices really depend upon?

Desirability

The big, big problem with predicting future purchase prices is that practically anything can affect desire. Many of those "things" have nothing whatsoever to do with collecting. It might be the last phone call, the temperature in an auction room, a car repair bill – almost anything can affect the desirability of collectibles. Desire and the willingness to spend are moving targets.

Professional sellers know they can sell more collectibles if they present them in the best possible light. Well-written descriptions and good images go a long way to enhance desires. But there are limits. One of the most uncontrollable features is the number of eyeballs dealers can attract. Controlling the number of collectors who see their offerings is terribly difficult.

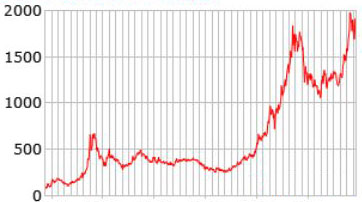

When it comes to predicting possible prices, we can measure collectors' past desires by what they bought, the number they bought, and how much they paid. The more recent the sales, the better. The more prices we collect, the better we can see underlying trends. Albeit it is impossible to be precise, the goal is to understand whether collectors have ben pushing prices higher or lower for all items in general and specific items in particular.

For instance, my data has shown that, in general, that prices of paper collectibles tend to drop during the hot summer months, hit their high points between Thanksgiving and Christmas, taper off after New Years and then rise again during tax season. Offer certificates when prices are trending up and selling becomes easier. Shop during the times when other collectors are out of the market and buying becomes cheaper.

The benchmark for this project

This project estimates prices that collectors are likely to encounter when they buy from professional dealers and professional auction houses in the United States. I use prices from top-tier dealers as benchmarks because their prices are the most stable and the most predictable. Yes, there are high-price dealers and low-price dealers. Buyers can choose to patronize any dealer they want. But understand that professional dealers offer the best guarantees, the scarcest items, and the most reliable service. They have the deepest inventories and they have the greatest number of network connections. If they don't have items buyers want, professional dealers usually know where they can find those. Dealers trade among themselves all the time.

I also use professional auctions as reliable price measurements, but in a different way. Whereas the goal of my estimates is to predict dealer prices, dealers do NOT share their actual sales prices with me. Auctions are excellent price sources and the actual sale prices are usually acquirable. Both collectors and dealers buy from auctions. Dealers are usually at a disadvantage when competing against collectors in well-attended auctions. After all, dealers must build profit margins into their bids. They cannot overbid without hurting themselves. On the other hand, dealers may have waiting buyers among their clientele. If so, they can sometimes bid higher because they know they can "turn" their money quickly. Either way, I can factor auction prices higher to reach dealer sell prices.

Everything related to collecting is a matter of choice — from the certificates buyers collect to where they choose to shop. Those choices reflect personal desires. I can not know why a particular collector desires to own a particular certificate. I cannot estimate with accuracy what a particular certificate will sell for on eBay or at an upscale, live German auction. I can, however, estimate prices you will likely encounter when buying from professional dealers in North America. As you can track your own records of winning bids, losing bids, and purchases from professional and amateur dealers, you will be able to factor my estimates up or down according to your own experiences.