Beware of uniformed promotions

Who is selling?

When professional dealers use the word "rare," they are probably correct. To them, "rare" means, "I've been in the business for _______ years and I don't remember seeing more than four or five." Maybe fewer.

What an amateur seller uses the word "rare" in a description, it is usually a promotional tool, unrelated to actual rarity.

"Rare!"

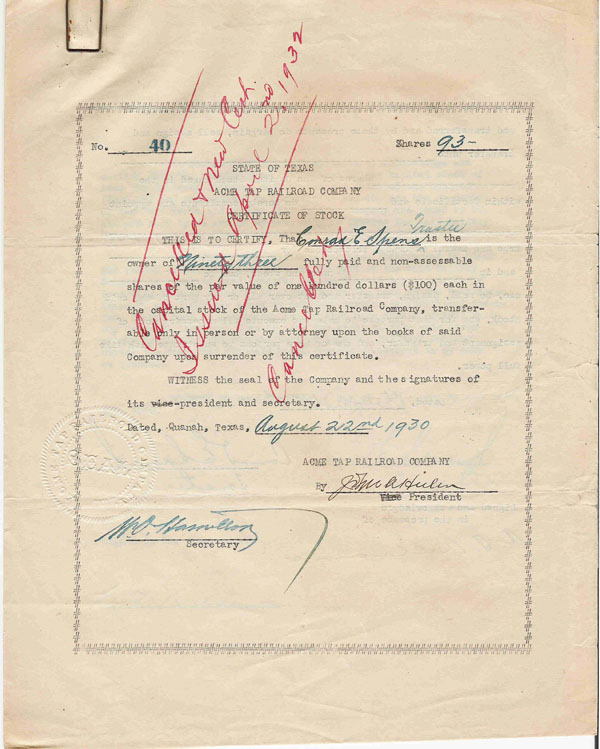

Handwritten and typewritten certificates are every bit as legal as superb engraved examples. There are very few known and they are seen for sale only occasionally, yet they seldom fetch prices commensurate with their rarity. This stock certificate was issued by the Acme Tap Railroad of Texas.(Courtesy John Martin)

Handwritten and typewritten certificates are every bit as legal as superb engraved examples. There are very few known and they are seen for sale only occasionally, yet they seldom fetch prices commensurate with their rarity. This stock certificate was issued by the Acme Tap Railroad of Texas.(Courtesy John Martin)

"RARE" is probably the most favorite word of amateur eBay sellers. Whenever I see the word "rare" in an eBay description, I always wish I had the capability to insert word "NOT" in big red letters.

If a seller has never seen a particular stock or bond before, it's only natural they think it is rare. In those cases, the word is used innocently and merely reflects a lack of experience. The problem with using the word "rare" so frequently is that it forms a bubble of self-delusion while decreasing its usefulness to the very buyers sellers are trying to reach.

But there are also sellers who use the term purposely and deceptively. These are the people who have a stack of twenty or thirty identical certificates, call them "RARE," and sell them for $15.

Can someone please tell me why anyone would try to sell a genuinely rare certificate for $15?

Just ignore the word. The majority of the time, "rare" is simply not true. On the day I wrote this, I found 116 rail-related items offered on eBay with the word "rare" in the title. Even more used "rare" in descriptions. Yes, a tiny number were scarce, but most were common. Here is a sampling of certificates described that day as "rare:"

- A listing of two certificates described as "RARE" and offered for $9.99.

(The items were probably salable for about $15 apiece if listed separately.)

- A "rare" Baltimore & Ohio certificate "signed by John Garrett" listed for $9.99. (Garrett signatures on B&O certs are quite common.)

- A "VERY RARE" bond offered for $28.

(A fair price, but the seller had already sold twelve examples of the same certificate on eBay. "VERY RARE" was very wrong.)

- A "Rare" Baltimore & Ohio stock certificate, (1930 <100 sh common) offered for $48.

(This variety is readily available in large quantities. for much lower prices.)

- A "RARE" remainder was listed for $62.

(This certificate came out of a lot of 125 sold by R.M. Smythe in 1993 for $1.62 each. Prices today are about $25.)

- A "Rare" certificate listed for $1,250.

(This certificate was, in fact, quite rare. However, it would probably fetch $300 to $400 in a professional auction.)

- A Pennsylvania Railroad certificate described as "Rare" and offered for $24.99.

(The variety regularly sells for $5 to $7 on eBay.)

Let's be clear

A collectible with only a hundred examples known would be considered "rare" in many other hobbies. In this hobby, a variety with a hundred certificates known might be considered borderline "scarce," but definitely not rare.

Autographs

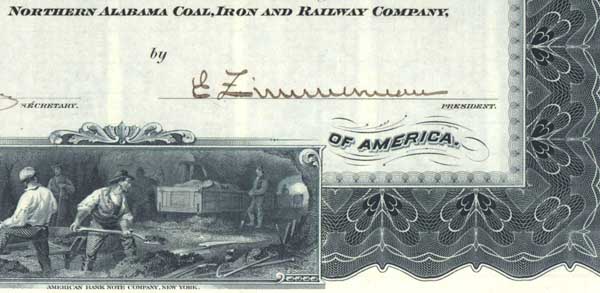

Eugene Zimmerman was a notable company exec, and his signatures are scarce except on bonds of the Northern Alabama Coal, Iron & Railway Co. His autographs, however, rarely fetch elevated prices. (Courtesy Vern Alexander)

Eugene Zimmerman was a notable company exec, and his signatures are scarce except on bonds of the Northern Alabama Coal, Iron & Railway Co. His autographs, however, rarely fetch elevated prices. (Courtesy Vern Alexander)

There is still occasional hype about the value of third- and fourth-tier celebrity signatures, but I am not seeing those promotions as frequently as I used to. It is true that specialists can and do pay extra for signatures from obscure individuals. However, just because there might be a small market among specialists for obscurities does NOT mean those very same signatures will have any value among general collectors. Nor does it mean that a current price paid by a specialist will hold into the future. The hard truth is that not all borderline "celebrity autographs" fetch reliable prices.

Try to do a count sometime of the number of people who are currently serving as governors, senators, representatives, and judges at state and federal levels. Then expand that number to get an estimate of the number of people who have served in those positions since the founding of the country. Don't forget to include territories, past and present.

After estimating that number, add in military personalities that achieved the rank of general. Generals were very popular in the Civil War, so the task of identifying that number should be a fun starting point. Of course, some men were promoted to the rank of general after the War. Some even after death. The task is not as simple as it might seem.

How about presidents of railroads? There have been roughly 28,000 railroads founded in North America since the 1820s. Some people served as presidents of multiple companies so the number of presidential signatures would be hard to calculate. Nonetheless, I would expect that a low guess would be in the range of 35,000 to 40,000 individuals.

Of course, there were also a goodly number of people who were famous for the sake of being famous. either through achievement, birth, or marriage.

I'm guessing there might be as many as 20,000 people who once signed a railroad certificate and who someone has labeled as a "celebrity." It is absurd beyond belief to say all their signatures have reliable value today. How many are going to attract elevated prices tomorrow?

Nonetheless, amateur eBay sellers hype obscure names as having extra value as autographs. I will put it bluntly. If a collector does not already know why someone is "famous" and whose signature will attract collector value in the future, there is no reason to break out a credit card. Why would someone pay extra money to acquire a certificate signed by someone they've never heard of?

Low numbers

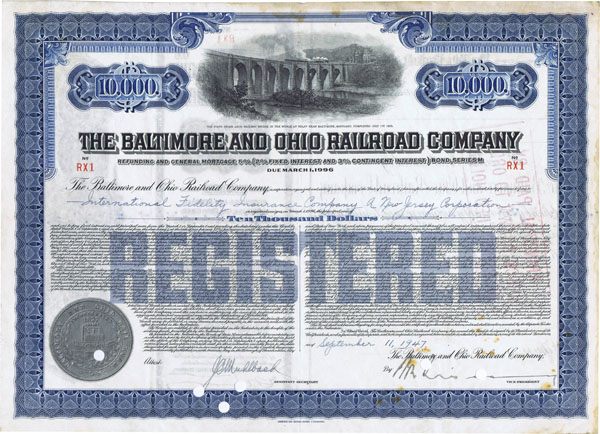

#1 certificates usually fetch notable premiums, and #1s from large companies like the Baltimore & Ohio Railroad are particularly hard to come by. (Courtesy William Knadler)

#1 certificates usually fetch notable premiums, and #1s from large companies like the Baltimore & Ohio Railroad are particularly hard to come by. (Courtesy William Knadler)

Hypes about certificates having "low serial numbers" appear several times a year on eBay. Numbers below 100 are often hyped as "low serial numbers." A few of those misleading promotions have involved numbers over 1,000. Although "1,000" is low compared to "100,000," they do not attract any attention from advanced collectors.

"What low numbers have collector value?" It is dangerous to answer that question, because I have seen a few certificates with serial #1 sell for no premium whatsoever.

Admittedly, those occurrences were exceptions. Many advanced collectors seek #1 serials. I have recorded premiums that have ranged from 10% to over 100%. I'd guess that 30% to 60% is probably about average.

Premiums paid for certificates with serial #2 are much lower. Certificate prices are so naturally variable, that it is often difficult to detect any premiums being paid. If forced to make a guess, I'd say #2s commonly fetch premiums of 10% to 20%.

I have spotted a few premiums seemingly being paid for serial #3, but not routinely. Any number higher than #3 is anyone's guess. I have encountered only one collector who specialized in a higher number and gladly paid premiums whenever he found certificates with that number.

Most companies commonly continued stock certificate numbering from issuance to issuance, so the lowest serial numbers for many stock certificate varieties might be in the thousands, maybe tens of thousands.

Condition

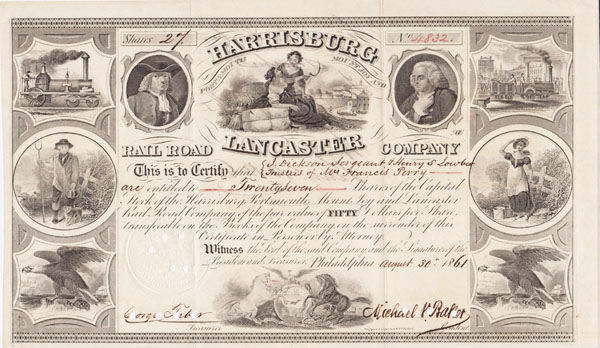

Consistent strong prices indicate certificates from the Harrisburg Portsmouth Mount Joy & Lancaster Rail Road Co are desirable in any condition. (Courtesy Kevin Nesbitt.)

Consistent strong prices indicate certificates from the Harrisburg Portsmouth Mount Joy & Lancaster Rail Road Co are desirable in any condition. (Courtesy Kevin Nesbitt.)

The majority of the collectors I've encountered in this hobby have migrated from coins, currency and stamps. Those hobbies are typified by strong premiums paid for better conditions. Our hobby is typified by certificates that have been formally issued as securities, and therefore should show evidence of ownership, transfer, and cancellation.

There are definitely premiums paid for certificates in better conditions, as long as there is evidence of having been used as securities. Those premiums are not dependable and are not remotely similar to the premiums paid in coins, currency and stamps. On average, issued certificates attract much better prices than unissued certificates. Uncancelled issued certificates commonly attract better prices than cancelled examples.

There are reasons for the lack of strong condition-related premiums in our hobby, but the most important is the low population of collectors. Until the number of collectors increases substantially, prices will reflect desirability rather than condition. I advise collectors to purchase certificates in the best condition possible, but not at the expense of desirability. Desirability will always trump condition in the current state of the hobby.

What about "Not in Cox?"

If you've collected certificates for a while, you have probably seen descriptions that say "not in Cox." I am honored to find my name among the collecting lexicon, but let's talk about what the phrase means.

What "not in Cox" means

Chances are, the phrase is being used to suggest that a new variety is being offered for sale and that it is probably scarce or rare. That has generally proven true. But remember, just because something is scarce, does not necessarily mean it is automatically worth more to collectors. Rarity does NOT automatically convey extra value.

The phrase "not in Cox" normally means I had not seen reference to a particular certificate before the September, 2018 release of the third edition of Collectible Stocks and Bonds of North American Railroads. Never mind that over 2,900 varieties and sub-varieties have been added by contributors, auctions, and dealer inventories since that time. Every one of those listings are available for everyone to see on this website. Since new discoveries are placed online two times a month, "not in Cox" is true only temporarily.

| Year |

New listings |

| 2019 |

881 |

| 2020 |

739 |

| 2021 |

567 |

| 2022 |

500 |

| 2023 |

215 |

| 2024 |

35 |

For many years, finding certificates that were "not in Cox" was not that hard. As the chart shows, it is becoming increasingly more difficult.

Newly-found certificates do not always achieve their highest prices at first appearance

Part of the reason that newly-discovered certificates do not always fetch their highest prices is because collectors fear they might represent the first release from a hoard. The possibility is real, although the chances have not proven great. The upside of purchasing new certificate varieties is that they might be "one-onlys." in that case, there may not be purchasing opportunities for years or even decades.

The downside is that no one except the seller may know how many more certificates are waiting to be sold. If a new listing turns out to be the first of a "hoard", large or small, then the highest prices paid tend to occur on the second or third appearances. After that, even if the "hoard" consists of only five or ten certificates, prices tend to drop with each new appearance. So-called "hoards" do not need to be large, and have not been for a long time.

Does the phrase "not in Cox" affect prices?

I have analyzed the potential effect a few times and have not found any relationship. There have been a few sales where I thought "not in Cox" might have positively affected prices. In those sales, I further analyzed the number of unsold items and found "not in Cox" listings among them. So, the short answer is that I have never found a predictable relationship, either positive or negative, between prices paid and the use of the phrase "not in Cox".

Again... I am deeply honored when sellers use the phrase "not in Cox," but I don't find proof that it has worked as a dependable promotion.