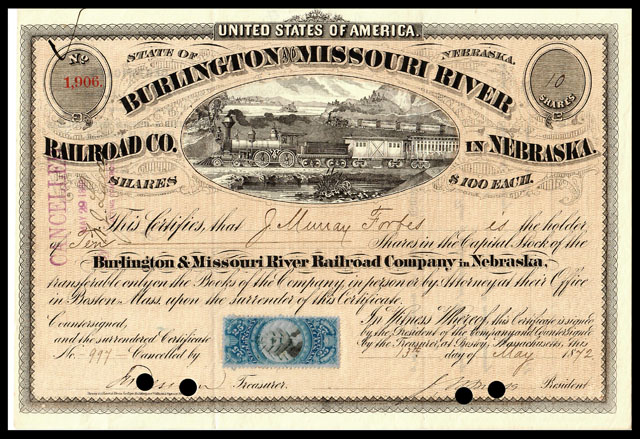

How to tell whether a certificate was issued or not

Why does it matter whether a certificate was issued or not?

Money! Experienced collectors pay prices for certificates (from high to low) like this:

- issued and uncancelled (highest prices)

- issued and cancelled

- unissued and uncancelled

- unissued and cancelled (lowest prices)

Specimens and proofs are special kinds of certificates, never meant to be issued. Depending on variables such as company, vignettes, printer, and other features, collectors generally value specimens and proofs near the top of the scale. See more at More than you EVER wanted to know about Specimens and Proofs.

Why is it sometimes hard to tell if certificates were issued?

Short answer: the propensity for human inconsistencies and mistakes

There were over 25,000 railroad-related companies that employed hundreds of thousands of people who issued certificates over the course of a century and a half. No matter the numbers of checks and balances, few companies ever issued stocks and bonds without making mistakes. Moreover, business practices and corporate customs varied widely between companies. Inconsistency was a certainty.

Regrettably, there are occasional instances where it is difficult to conclusively decide whether certificates were legitimately issued or not. This is because:

- there are many legitimately-issued certificates that lack one or more necessary features of issuance

- partially issued certificates show many features that would indicate legal issuance.

Since collectors assign more value to fully-issued certificates, it is important to be able to tell whether certificates were, in fact, issued. So how do you tell the difference between partially-issued certificates and fully-issued certificates when both lack critical features?

The characteristics of fully-ISSUED certificates

In ideal circumstances, issued certificates show these features:

|

Registered

stocks

|

Bearer

stocks

|

Registered

bonds

|

Bearer

bonds

|

| Owner's name |

x |

|

x |

|

| President's signature |

x |

x |

x |

x |

| Treasurer's signature |

x |

x |

x |

x |

| Trust company signature |

(x) |

|

(x) |

(x) |

| Trustees' signatures |

|

|

x |

x |

| Corporate seal |

x |

x |

x |

x |

| Issue date |

x |

x |

x |

x |

| Serial number |

x |

x |

x |

x |

| Number of shares |

x |

x |

|

|

| Bond value |

|

|

x |

x |

| Revenue stamps |

r |

r |

m |

m |

x = should be present

(x) = should be present if dedicated space or line was provided

r = should be present if issued from late 1862 to 1878 or 1898 to 1902

m = usually attached to original debt contract (mortgages, etc)

Generally speaking...

- Legitimately-issued certificates occasionally lack one feature normally necessary for issuance. If missing one important feature, then the remaining features must show compelling evidence of issuance.

- Partially-issued certificates often show one or more features of issuance. However, even taken together, features are not sufficiently compelling to prove certificates were issued.

- Non-issued certificates show few, if any, features of issuance.

Discussion of various features

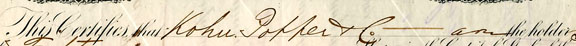

Owner's name

In the early days of European "joint stock" companies, stock certificates and bonds were "bearer" instruments. People who held such certificates were considered true and rightful owners, regardless of how they acquired their certificates. Companies often could not tell the difference between criminals and their victims. By their very natures, bearer instruments, had significant problems.

Bearer certificates, both stocks and bonds, do NOT show owner's names. Consequently, it is not possible to use this feature to conclusively tell if bearer certificates were issued.

Only a tiny handful of stock certificates issued in North America were bearer instruments. This means that essentially all North American certificates showed owners' names and those names were registered on the books of companies. With extremely few exceptions, legitimately-issued North American stock certificates SHOULD show owners' names.

By contrast, half all North American bonds were bearer bonds and consequently do NOT display owners' names. Bearer bonds can be identified by wording in the first few lines of text. Wording can vary, but they will usually display the words holder, bearer or "___________________ or assigns."

By the mid-1890s, registered bonds had gained popularity and owners' names began appearing in greater and greater numbers. Like stock certificates, legitimately-issued registered bonds SHOULD show owners' names.

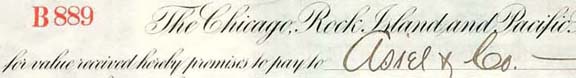

President's signature

All stock and bond certificates SHOULD show the signature of a primary company officer. On older certificates, this was the company president. On newer certificates, it was sometimes the chairman of the board.

There were numerous exceptions to this rule. Primary officers could have been vice-presidents, presidents pro tempore, and so forth. Jay Gould's son George is known to have signed many MKT certificates as "3rd vice president."

With rare exception, a certificate was not issued if missing a primary officer's signature.

Treasurer's or Secretary's signature

In addition to primary officers' signatures, most legitimately-issued stocks and bonds SHOULD also carry signatures of company treasurers or secretaries. A few companies let lower-level clerks sign certificates.

Legitimately-issued certificates should show two signatures, but when a signature is missing, it is often that of a secretary or treasurer. The presence or absence of these signatures is not normally proof-positive evidence of issuance or non-issuance.

Trust company signature

In the earliest days of railroading, companies were small and dealt with few investors. Investor turnover was usually limited.

Companies consolidated and merged into increasingly larger and larger companies with larger and larger numbers of investors as time went by. The length of time investors held securities dropped steadily, meaning that companies had to spend ever-increasing time transferring ownership and recording transactions.

Ultimately, it became necessary for large companies to let dedicated, third-party companies sell, transfer, and record security transactions.

It is hard to pinpoint exactly when trust companies and banks assumed this important role, but their signatures appear sporadically before the 1900s.

By the late 1920s, the turnover of securities became huge. Trust companies, banks, and clearing houses became highly important to the orderly buying, selling, and transfers of securities. Trust company registrations had become almost universal by the time of the 1929 stock market crash

As those outside service companies became prevalent, bank note companies printed special signature lines for trust company and bank registrars. Once this practice became formalized, the number of problematic certificates dropped dramatically. Trust company signatures were the last signatures applied and represented, therefore, the last step where accuracy was checked.

As a rule, IF there is a space for a trust company or bank signature on a certificate, and that signature is blank, then the certificate was probably NOT legitimately issued. There may be exceptions, but those exceptions will be highly rare.

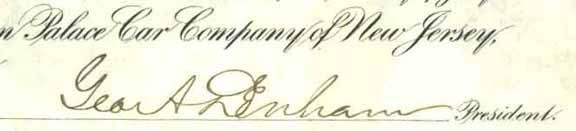

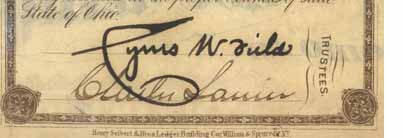

Trustees' signatures

Bonds often have spaces for signatures of two or three trustee. Trustee signatures commonly appear on the backs of bonds, often on the panel meant to be seen when the certificates was properly folded.

Trustees were often important industrialists, so some signatures carry significant collector values, far above the value of the certificates on which they appear. This example shows the signatures of Cyrus Field and Charles Lanier.

As usual, there is no hard and fast rule concerning trustee signatures. Their presence generally implies certificates were legitimately issued and their absence generally implies certificates were not issued.

The main value of checking trustee signatures is to determine how they compare with other certificates of the same bond issue. If other issued bonds of the same series are signed, then trustee signatures are highly indicative of genuine issuance.

If other bonds of the same series lack trustee signatures, then those bonds were probably not issued..

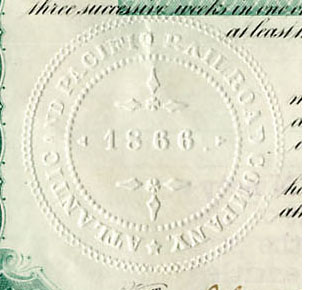

Corporate seals

Corporate seals are official impressions made with a handheld or electric, plier-like device . The jaws of the embosser hold a circular die, that when squeezed, crinkles and breaks paper in a design that shows a company name.

Corporate seals are used to validate deeds, contracts, and other official documents including stocks and bonds.

Because of their official nature, corporate seals are closely guarded. Theoretically, they are meant to be used only by corporate officers in the normal course of official business. Theoretically, every stock and bond issued by a company should carry a corporate seal.

If stock or bond certificates show the impressions of corporate seals, then there is high probability that the documents were officially issued.

However, there are rare examples of issued certificates that lack corporate seal impressions. When such certificates have appeared, there has always been additional compelling evidence that strongly suggested legitimate issuance.

Many old deeds and documents, including stocks and bonds, show corporate seals embossed on colored paper that was applied to the body of documents. The colored paper often had a light adhesive on the back. It seems likely that clerks licked and applied circular or square paper seals immediately before embossing with corporate seals. The colors of the applied paper seals were insignificant and highly variable.

Be aware that some companies pre-printed corporate seals on their certificates. this is especially true with late-date bonds. In these cases, many companies did not emboss their certificates at all.

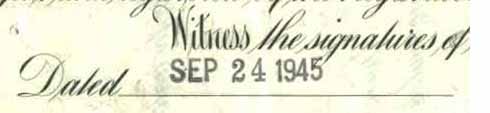

Dates of issuance

The dates of bearer bonds are normally printed at the bottom right side of certificates, immediately above presidents' signatures. Virtually all other stocks and bonds carry handwritten, typed, or rubber-stamped dates. Dates were probably the least important part of certificate issuance, so collectors will occasionally encounter legitimately-issued certificates without dates.

By itself, the presence or absence of dates neither proves nor disproves legitimate issuance.

However, when taken with other features such as signatures, the absence of dates can be very important. For instance, missing dates combined with missing signatures is nearly conclusive evidence of non-issuance.

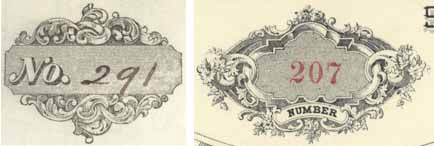

Serial numbers

It would be great if we could say that all issued certificates display serial numbers. While almost always true, there are a FEW legitimately-issued certificates without serial numbers.

To my knowledge, all legitimately-issued certificates that lack serial numbers are those where serial numbers were meant to be handwritten (like the example on the left below).

As you can imagine, writing serial numbers by hand was time-consuming and prone to mistakes. Therefore, just because serial numbers are absent is not proof of non-issuance. Rather, like other indicators of issuance, serial numbers must be considered with other features.

For instance, if a certificate lacks a serial number AND lacks an embossed seal, then there is almost 100% certainty that the certificate was not fully issued.

Numbers of shares or bond value

I feel safe in saying that all legitimately-issued certificates show either numbers of shares or bond values. I do not know of a single exception.

If certificates lack numbers of shares or currency values, I think you can safely say certificates were not legitimately issued.

Partially issued certificates (certificates that were voided for unknown reasons prior to delivery) CAN show share or dollar values. And therein lies my typical advice. Certificates that display values, must show additional features that fully confirm genuine issuance.

Revenue stamps

The United States government required tax payments for stocks and bonds issued during two periods of American history: 1862-1872 and 1898-1901. Additionally state governments and certain European governments taxed those transactions at other times.

During those periods, it was common to pay taxes by affixing revenue stamps to fronts of stock certificates. The payments of taxes on bond transactions were more variable. Bonds can carry revenue stamps, but in many places, it was legal (and much less troublesome) to affix stamps to the original mortgages against which the bonds were issued.

When revenue stamps were applied to certificates, they were often "tied" to documents by handwritten dates, initials and rubber stamp impressions.

Dealing with revenue stamps benefited the government, not the companies. In an effort to streamline the process, companies often paid taxes in advance and pre-printed stocks and bonds with colored revenue imprints.

It seems logical that the application of gummed revenue stamps would have been the last step prior to handing over certificates. However, unissued certificates with revenue stamps affixed are known from the Civil War taxing period (1862-1872.) Similarly, large numbers of unissued certificates are known with imprinted revenues.

On the opposite side of the equation, there are legitimate certificates known to have been issued during both periods that lack the required revenue stamps.

Considered alone, the presence or absence of revenue stamps (during the required taxing periods) can neither confirm nor deny the legitimate issuance of any certificate, even if the stamp was "tied" with a signature or rubber stamp. Instead, revenues should be considered among other features when trying to decide whether certificates are fully-issued or not. (Special thanks to revenue specialist Eric Jackson for help with this section.)

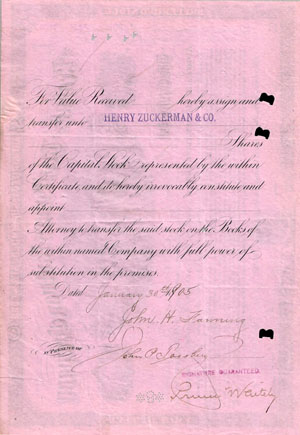

Evidence of transferal

Large numbers of stock certificates were legitimately issued and transferred without any evidence on certificates themselves. Therefore, the absence of any writing or assignments on backs of stock certificates is not evidence of either.

However, if there is evidence of transferal on the backs of stocks, then that is proof positive of issuance.

Is that writing also evidence of cancellation? That depends on who is answering.

If a company, registrar, or clearing house is answering, then evidence of transferal is definite evidence of cancellation in company records.

If most collectors are answering, evidence of transferal does not mean anything unless there is accompanying evidence of paper cancellation.