The effects of hoards on prices

What is a hoard?

People throw around the term "hoard," but that doesn't mean there is much agreement about its meaning. A "hoard" might mean 10,000 certificates. It might mean 10 certificates. Regardless of the number, the release of hoards affects prices.

There seems to be general agreement that prices are likely to drop when hoards of certificates hit the market. The question is not IF the release of hoards will hurt prices, but what the effect will have on prices and for how long.

How much will a hoard hurt prices?

In most cases, the depth and duration of price depression depends on the seller. The main questions to answer are:

- How fast does the owner want to liquidate?

- How many certificates of the same design are in the hoard?

- How many collectors want items in the hoard?

- How much the hobby knows about the hoard?

These questions are nothing mysterious; they simply reflect supply and demand.

Let's say 500 people want one particular variety of certificate, but only ten examples are known. That is supply. No matter how much money they may have, 490 collectors are not going to get what they want. THAT is demand.

Conversely, imagine there are 500 examples of a very plain certificate and only 10 people really want that variety. No matter how low prices fall, selling any more than 10 certificates will be difficult. THAT is over-supply.

Finally, imagine a situation where there are 500 certificates and 500 collectors who want them. That would be balanced supply and demand. One would expect balanced and predictable pricing. In our hobby, however, there is simply no easy way to reach all 500 collectors. Certificates would need to be spread among all professional dealers, all part-time dealers, and all professional auction houses as well as eBay in proportion to their contacts. That can never be done, hence price inequality rules across all markets.

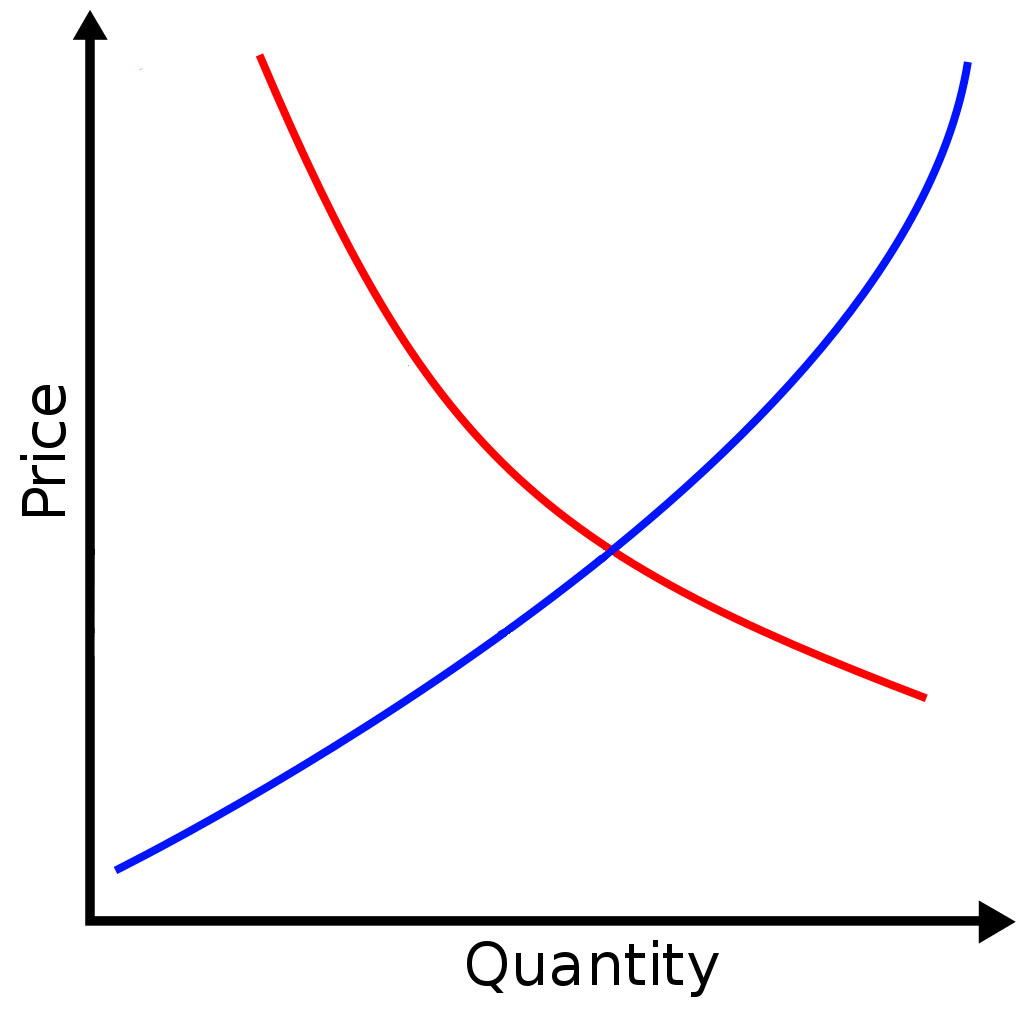

Some variation of the chart at right has been used thousands of times. It merely illustrates that the greater the quantity of items to be sold (the blue line), the lower the price (the red line.) If someone wants to sell faster, the red line (price) must steepen and shift to the left.

The number of collectors in our hobby is fairly limited, as are the numbers of ways to reach them. That means we would need to draw demand curves differently for both the types of certificates being sold and the avenues for selling. A professional auction house with a huge mailing list will sell faster and realize better prices than a personal website with only a few hundred participants.

And then, there is a certain reality that demand reflects desire. Let's be honest; not all certificates create much desire.

It is against this backdrop that hoards, no matter their sizes, affect prices.

Selling quickly rarely results in good prices

This is an inviolable rule, but it is uncanny how many people choose to ignore it. If someone wants to dump a hoard quickly, they must be willing to accept less per item. The more quickly, the lower the price.

Experienced sellers liquidate hoards, even small hoards, over months or years. They are trying to balance demand and their abilities to reach collectors against their over-supply.

Patience is a necessity In the liquidation of hoards.

Higher auction prices might reflect increased demand

One might assume that high auction prices indicate high demand. And they might be right.

However, gauging demand is tricky because collector interest rises and falls throughout the year and with ups and downs in national economies. Moreover, it takes multiple sales to determine whether an upward trend really exists, or whether high prices merely result from the actions of a few collectors satisfying an otherwise thin demand.

How does information about hoards affect prices?

Information about hoards does affect prices, but predicting directions is tricky. Sometimes, full disclosure of a hoard's existence generates interest and a commensurate increase in demand for selected items. There are other times when knowledge decreases both demand and prices.

Like most other commodities, knowledge about hoards is neither equally distributed nor equally appreciated. That is why predicting the effect of disclosure is so difficult.

In general, simply understand that hoards usually push prices down. The larger the hoard, the deeper and longer the effect.