Warrants

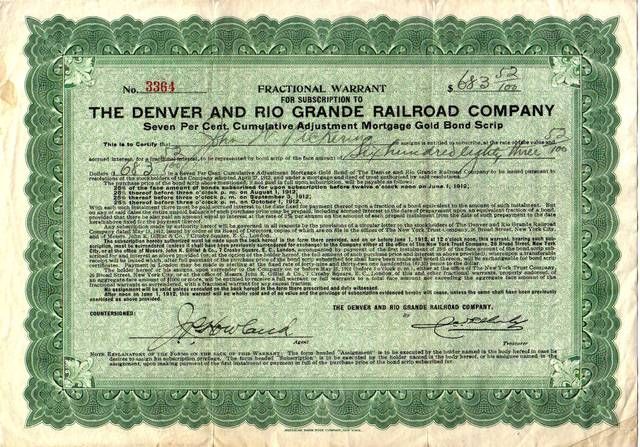

"Warrants" gave holders the RIGHTS but not the OBLIGATIONS to use them as intended. This project catalogs warrants only those warrants that were convertible into securities. For instance, a warrant might give a person the right to buy share of stock at a specific price before a specific expiration date. The holder of the warrant was not obligated to buy shares.

Warrants cataloged in this project

Only a limited number of warrants are currently cataloged because they generally had ephemeral values. Once their useful lifetimes had passed, they had no values and were generally discarded. The ones most commonly seen in this project resemble ordinary non-vignetted stock certificates. As a rule, warrants of this type are heavily burdened with text explaining their purposes and how investors should use them. They commonly gave investors the option to purchase shares at predetermined prices for definite and stated periods of time.

The second group of cataloged warrants represented payments for dividends or interest. They had no value other than by redemption into company stocks or bonds. Such warrants may or may not have had expiration dates. Warrants of both types were generally considered "fungible," meaning they could be sold or traded to other investors for equal value.

Warrants NOT cataloged in this project

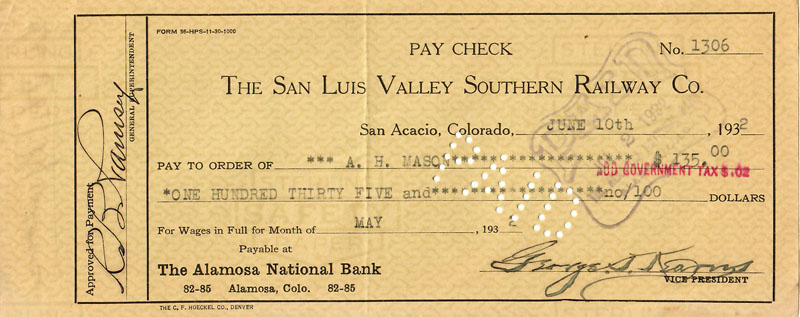

The most common types of warrants considered OUTSIDE the scope of this project were business-sized checks issued by railroad companies. Not all were labeled as warrants. Check collectors have the option of collecting from tens of thousands of such warrants issued by hundreds, possibly thousands of railroad companies. If interested in collecting checks, visit the web site of the American Society of Check Collectors. Sadly, the society became inactive in December, 2018 due to low membership.

Most coupon bonds refer to attached coupons as "warrants." I do not consider coupons as parts of securities once they are detached. Like most checks, most coupons had no expiration date. Also like checks, they were intended to be converted into cash. Of course, that cash could have been used for any purpose. Consequently, coupons are NOT cataloged in this project.