Fractional stocks and bonds

Fractional stocks

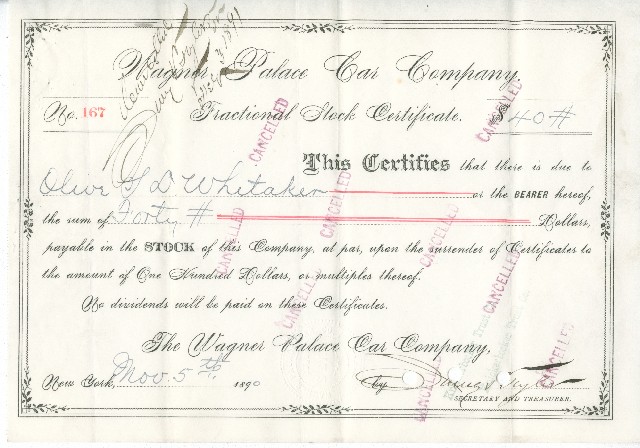

Fractional stock certificates represent ownership of less than whole shares of stock. In other words, they represent some "fraction" of a share. Fractional certificates are most common among railroads that sold stock with $100 par values. Fractional certificates rarely show vignettes.

Fractional stock certificates often include the word "scrip" and/or "warrant" in their titles. Although origins are seldom stated on certificates, it seems that many fractional stock certificates probably represented dividend payments made to stockholders, but which were redeemable only by conversion into more stock. As a general rule, collectors pay significantly less for fractional certificates than regular stock certificates unless those companies are extremely rare.

Fractional bonds

By extension, "fractional bond certificates" represented debt obligations smaller than the smallest bonds that companies issued. Most fractional bonds represented down payments on $1,000 bonds. Depending on the company, fractional bonds may also be titled "fractional bond scrip" or "fractional bond warrants." Some companies made interest payments to bond holders with these certificates and then made them redeemable only through purchases of whole units of company stocks or bonds. One must wonder how companies evaded terms of their own bonds wherein they clearly promised payments in gold coins or lawful currency.

Generally plain appearances

Like fractional stock certificates, fractional bonds are generally plain in appearance. They seldom show vignettes. As a general rule, fractional bonds include a large amounts of text explaining redemption policies and they are about half as common as fractional stocks.

Most fractional certificates state that they did not earn dividends or interest until they were converted into full-fledged stocks or bonds. This practice saved companies a lot of paperwork, but also substantial money. Unless investors owned many shares or several bonds, fractional certificates might never have been converted into whole shares or whole bonds for several years.