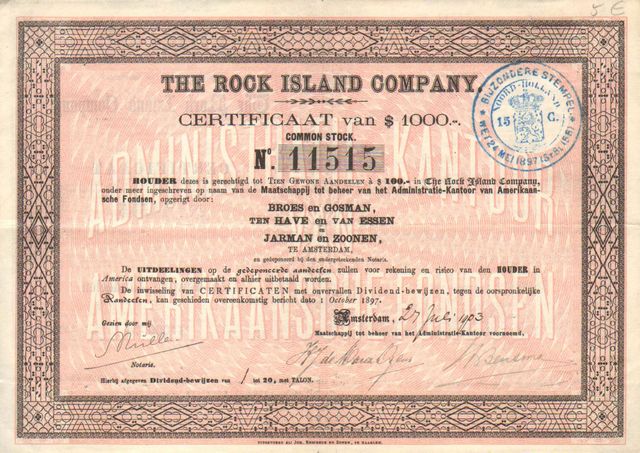

Dutch fund certificates

Cataloging

Categorizing these certificates is somewhat challenging because these Dutch certificates appear in North America very infrequently. These certificates have distinctly European appearances and collectors may not realize the important roles they certificates played during the continent's greatest period of expansion. These certificates don't fit into slots most collectors are used to. (Images on this page courtesy of Geert Leemeijer.)

Although formed for entirely different purposes, the closest North American correlative of the Dutch funds would be today's mutual funds. The difference is that mutual funds invest in many companies while the fund certificates represent investments in single companies.

The Dutch were risk-tolerant

Even by the early 1850s, railroad companies had begun to run short of sufficient numbers of North American investors to fund construction, especially for expansion into riskier frontier areas. The obvious places to look for offshore money were London and Amsterdam. Money was available in both, although the Dutch had proven especially risk tolerant to joint stock companies. They were also highly savvy investors, proven by their 250-year history with the United (aka Dutch) East India Company. In the 1850s, many American railroads were offering high interest rates on their bonds, certainly more than enough to attract attention abroad. Some companies offered interest as high as 10% per year although history proves such interest rates were unsustainable over-promises.

Early investors in North American railroads

We're unsure when Dutch investment started, but by 1857, Dutch investors held over $14,000,000 worth of 6% and 7% bonds of the Illinois Central Rail Road (IC) worth roughly $495 million in 2024 dollars. Those same investors were also heavy traders in Illinois Central stocks and traded them back and forth among themselves with simple signature endorsements. Slow cross-ocean travel prevented rapid recording of ownership changes, so dividends sent by the railroad company commonly found the wrong investors.

To mitigate that problem and increase liquidity for Dutch investors, two stockbrokers formed an Adminstratie Kantoor (Administrative Committee) in 1863 to hold Illinois Central stock. And they did that even in the middle of the American Civil War! The concept was for the committee to hold IC stock in the name of the committee and issue certificates for $100, $500 and $1,000 to its groups of investors. In that way, investors gained the luxury of easier trading and easier receipt of dividends.

The committee concept blossomed and certificates of numerous committees were ultimately listed on the Amsterdam and Rotterdam stock exchanges.

Committee ownership of North American securities quickly extended to bonds and the brokers usually printed certificates in denominations of $1,000 to correspond with typical North American railroad issues. The net ownership of railroad securities by Dutch committees allowed them to exert influence over dividend and interest disbursal. Overall, Dutch investors preferred passive involvement in American railroads although committees sometimes needed to install their own board members or directors when management proved incompetent or abusive.

Accidental railroad ownership

Because they maintained such heavy bond ownership, Dutch committees occasionally gained control of railroad companies through foreclosure. There were exceptions, but the Dutch generally divested outright ownership as soon as they could find willing buyers. Notable temporary ownerships among railroads included:

- Cairo & St Louis Rail Road Co.

- Cleveland Akron & Columbus Railway Co.

- Denver Pacific Railway & Telegraph Co.

- Kansas City Pittsburg & Gulf Railroad Co.

- Memphis Paducah & Northern Railroad Co.

- Paducah & Elizabethtown Railroad Co.

The number of extant certificates from Dutch investment committees is merely a hint of the number once available. Fewer than 70 companies are currently represented. The majority of certificates currently known are dated after 1910 with only a limited handful of certificates recorded with pre-1890 dates.

Source information

Collectors wanting to learn more about Dutch investment committees and how they worked are directed to:

Augustus J. Veenendaal, Jr., 1996, Slow Train to Paradise: How Dutch investment helped build American railroads, Stanford University Press.

Other European committee ownership of North American securities

A few groups similar to Dutch committees developed in England, Germany, Belgium and possibly other countries in order to hold North American railroad securities. This project knows almost nothing substantive about them. One example from Belgium was reported by a Dutch collector. Very few are currently known from the United Kingdom or elsewhere in Europe.