Variety numbering

Why number?

The whole idea of assigning numbers to varieties is to add organization to an inherently random assemblage of certificates. Numbering makes it easier to both find and re-find specific certificates. If varieties were not segregated in some orderly fashion, it would be necessary for users to read every description in every company they were interested in. And then, do the same thing every time they acquired a new certificate.

This system

As described in Catalog numbering explained, I assign a multi-character alphanumeric code to every certificate identified in the railroad and coal company specialties. Codes look like MIS-716-S-17 where:

- 'MIS-716' is the company number

- 'S' is the code for the certificate type

- '17' refers to a specific variety

The ideal numbering

Ideally, variety codes progress numerically by both date and denomination from 1 to 99 with listings spread out in some sensible manner to allow room for new discoveries. For instance, S-20 should be older the S-30. And, ideally, S-20 would be an odd-share certificate followed by S-21 as a <100-share and S-22 as a 100-share.

S-20 = odd-sh

S-21 = <100-sh

S-22 = 100-sh |

The reality

Unfortunately, ideal numbering is not always realized. New discoveries always appear randomly. We will never know what the next find might be.

Numbering shown in the previous example is highly typical. it is equally typical for previously-unknown and scarcer denominations to appear several years later. If a 50-share stock certificate were to appear suddenly, we would have several numbering options, although none would be particularly ideal. Moreover, if a 50-share denomination appeared, maybe we should plan other possible denominations. Here are possible approaches when new stock denominations appear randomly.

S-20 = odd-sh

S-21 = <100-sh

S-22 = 100-sh

← S-23 = 50-sh |

S-20 = odd-sh

S-21 = <100-sh

← S-20a = 50-sh

S-22 = 100-sh |

S-20 = odd-sh

S-21 = <100-sh

← S-20a = ??

← S-20b = ??

← S-20c = 50-sh

S-22 = 100-sh |

Massive expansion

Although it has happened only a few times, some companies have run out of space at the high end of numbering. For example, late-date bonds of the Baltimore & Ohio Railroad pushed numbering beyond the anticipated limit of 99. That does not mean the B&O has more than 99 varieties of bonds cataloged, but spacing in numbering lower in the series made it more sensible to extend numbering past 99.

General numbering customs

Whenever the first stock or bond for a company appears, I normally start numbering at:

- S-30 for <100-share or odd-share capital or common stocks

- S-31 for 100-share certificates

- S-70 for <100 share or odd-share preferred certificates

- S-71 for 100-share preferred certificates

- B-40 for $1,000 bonds*

* some bond issues state the denominations printed

The numbering for "Other" certificates can be all over the place, but "subscription receipts" usually receive the lowest numbers with assessment receipts a bit higher. Receipts for partial payments on stocks and bonds are commonly in the O-20s and O-30s. Temporary and "interim" stocks and bonds commonly receive numbers in the O-40s and O-50s. Certificates of deposit were usually issued late in the lifespans of companies and normally receive numbers of O-70 and above.

Numbering can seem very arbitrary because many early listings originated from unillustrated auction catalogs with minimal descriptions. Vague descriptions like, "Receipt, orange" were common. An original catalog number of O-30 might have survived with that description for twenty years before an image of an orange certificate appeared that proved to be a certificate of deposit which should have been numbered much higher. Discoveries are slowly cleaning up inadequate descriptions from decades ago, but many certificates are so rare that they still await re-discovery after twenty of thirty years of hiding in a collection.

What about numbering certificates that SHOULD exist, but are not yet known?

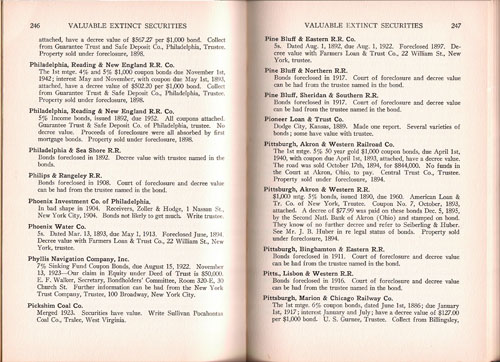

Extinct bonds listed by R. M. Smythe in Valuable Extinct Securities, 1929

Extinct bonds listed by R. M. Smythe in Valuable Extinct Securities, 1929

I list certificates only when definite proof of their existences emerge.

Coupons occasionally appear for sale that originated with bonds that no longer seem to exist. My policy is firm; I will not catalog bonds until proof of their existence is confirmed. If certificates are not known to collectors, how could anyone consider them "collectible?"

In a similar vein, old Poor's manuals, Moody's manuals and R.M. Smythe's Valuable Extinct Securities could help us identify hundreds, if not thousands of additional certificate issuances. Those references, of course, tell us nothing about certificate designs.

I do not necessarily create new varieties based on minor variations

I came to the stock and bond hobby from the paper money hobby. I can spot micro-varieties as well as anyone. However, I try to avoid flyspeck varietization. (See Flyspeck sub-varieties for discussion.) I will not number every tiny, microscopic variation. I want varieties to be easily identifiable by the majority of collectors. Driving that philosophy is the inescapable fact that collectors currently enjoy reporting minor sub-varieties but do not pay premiums for those minor features, regardless of rarity.

I fully recognize that many collectors truly enjoy searching for minor features and differences, especially those collectors with long experience in the coin and stamp hobbies. Minor differences can create large premiums in those hobbies. Our hobby sees no such relationship. There are simply too few collectors and too many great rarities for micro-varieties to create any demand.

Deciding which minor features to "varietize" and which ones to ignore is tricky. No advanced collector would accept that certificates printed by American Bank Note Company were identical to those by Homer Lee Bank Note Company. Certificates printed with '188_' dates are not identical to those printed with '19__', but the differences SEEM minimal. Nonetheless, I choose to report printed dates because they frequently signal other variations that are too difficult to describe with few words.

Conversely, creating varieties to describe 2mm differences in the sizes of vertical format bonds is just plain silly unless those sizes correspond to additional, more easily seen features.

While not a hard and fast rule, my basic desire is to group certificates into major varieties based on features that can be seen arm's length or in mid-resolution images. If collectors can hold certificates of different varieties in two hands and recognize them as different, then they are clearly separate varieties. The harder it is to see differences, the less inclined I am to differentiate.

Cataloging handwritten certificates and documents

I DO create separate varieties for handwritten, typewritten and mimeographed stocks and bonds. They were entirely legal certificates equal in status to the most perfectly engraved and executed certificates ever created by major printing companies.

I DO NOT create listings for handwritten documents related to:

- dividends

- transfers

- subscriptions

- assessments

- proxy bids

- powers of attorney, etc.

These were not produced by railroad companies and are therefore excluded.

Features NOT cataloged

I do NOT create separate numbered listings for these features:

- autographs (see more at Autographs and listing criteria.)

- signature combinations of company officers

- variations in types or degrees of cancellation

- variations in trust company, registration company or clearing house names

- variations in back designs

- handwritten share values

- minor size differences

- minor color variations

- paper colors

- variations in colors of embossed paper seals