Imported from: Google Blogger site

Original publish date: September 20, 2011

Round lot shares

Shares are commonly traded on the New York and other exchanges in standard trading units of one hundred shares. On U.S. exchanges, shares that trade in units of 100 shares are referred to as "round lots".

Before the advent of heavy electronic trading, round lots traded faster and more cheaply than either "odd lots" (fewer than 100 shares) or "mixed lots" (odd lots combined with units of one hundred).

Obviously, it takes a lot of money to freely trade round lots, especially when dealing with high-priced stocks.

I bring round lots because Max Hensley (editor of Scripophily magazine) and I recently exchanged a series of emails wondering about the extent that round lots are reflected among collectible stocks. Unfortunately, with the exception of my database on U.S. railroad stocks and bonds, we currently have no access to reliable numbers. I can make my database divulge all sorts of summaries, but we cannot possibly know whether the trends we see there translate to other specialties or the rest of the hobby.

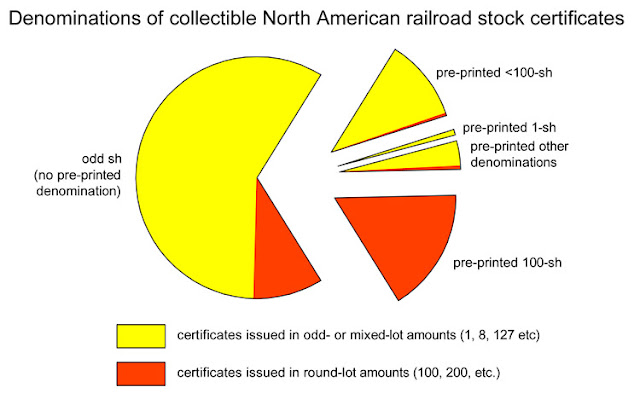

In gross terms, round lots (any increment of 100 shares) represent about 26% of all certificates I currently have recorded in the database. Provided shares were available, investors have always been able to buy stock certificates in any denomination that suited them. It turns out that the most popular single denomination was 100 shares (24%) with the second most popular being 1 share (14%).

The lion's share of collectible certificates currently reported are what I call odd-share certificates. 68% of all collectible certificates currently recorded are certificates with no pre-printed denomination. Such certificates usually have a simple line or a blank spot meant to be filled in with the number of shares being purchased.

The second most populous category is pre-printed 100-share certificates (17%) followed closely by pre-printed less than 100 share certificates (11%).

Companies issued certificates with other pre-printed denominations, but none were very popular. One-share certificates were popular in Mexico, but relatively few have been recorded from U.S. companies. A few companies tried other odd-lot denominations such as 10-, 25- and 50-shares, but not a tremendous number survive. Very few companies pre-printed large round-lot certificates such as 500- and 1000-shares.

The chart above shows the percentage of round-lot denominations that are currently known to appear on odd-share certificates and the four major groups of pre-printed certificates. As mentioned above, certificates denominated in round-lot amount account for about 26% of the collectible certificates in my database.

Both Hensley and I thought that the percentage of round lots should have been higher. Survivorship is certainly a great unknown. The current understanding is that round lot trades greatly outnumber odd lot trades in today's stock markets. Does that assumption extend far back into the past? Were round lots as popular in the past as they are supposed to be today?

The term "round lots" has been used for quite some time I can find the term in common use as far back as the 1850s in published discussions about shipments of iron, cotton, tin and other commodities. I can find reference to "round lot" stock trades (sometimes also known as "even lots" and "board lots") as early as 1930. However, Henry Clews never mentioned the term in his 1887 book Twenty-Eight Years on Wall Street. It is also curious that Haight & Freese, the famous Boston "bucket shop" operator, never mentioned "round lots" in any of its series of Guide to Investors from 1894 to about 1904. Merriam Webster's Collegiate Dictionary estimates the term was used as early as 1902, so I defer to its robust etymological research.

I suspect the earliest certificates with a pre-printed 100-share denomination appeared around 1868 or 1869. The earliest examples in the database are certificates from the Milwaukee & St Paul Railway and the New York Central & Hudson River Railroad, both dated 1870.

While I suspect that less than 100 share certificates probably appeared at the same time as the earliest 100-shares, the earliest surviving <100-share examples date from 1872 (from the International Railroad and other companies.)

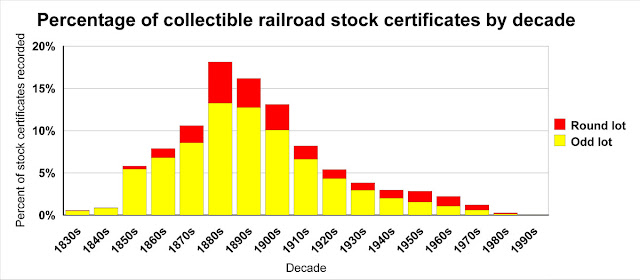

Up until the time that 100-share certificates first appeared, round-lot trades accounted for about 10% of the certificates in the database. I have absolutely no way of knowing whether that number represents the percentage of all trades before 1870 or not. By the end of the 1870s, surviving round-lot certificates had grown to represent 19% of the trades (according to surviving certificates.)

After noticing the growth in round-lot certificates, I queried the database to give me round-lot and odd-lot certificates by decade from the earliest to the latest.

The chart below shows how the percentage of round-lots (in red) have trended through time. It is readily appearent that the percentage of round-lots increased substantially in the last four decades. Unfortunately, because of my own time constraints, I rarely record recent certificates because they are normally priced far below my $20 cutoff. Consequently, readers must understand that the database is skewed toward earlier certificates.

Regardless of the accuracy of the count of recent certificates, the chart definitely shows a justification for 100-share certificates appearing when they did. The chart also illustrates how strongly odd-lot trades have persisted, very much counter to prevailing wisdom.

One final note.

I also checked whether there was a propensity for celebrity autographs to be associated with round-lot trades. There IS a relationship, but it is very tricky to draw conclusions. First, the number of survivng samples is relatively low. Second, many celebrity autographs (Gould, Dix, Durant, Sage, Devereux, Forbes, William K. Vanderbilt, and Cornelius Vanderbilt II come to mind) appear on stock certificates in the roles of corporate officers as opposed to stockholders. If I limit the search to simply stock ownership, celebrity autographs appear on round-lot certificates with a little greater frequency, but it's insignificant. We must remember that the biggest stock operators in history (Gould, Harriman, Vanderbilt, Little, Sage, Mellen, Roberts, Morgan, et al.) purposely hid their ownership behind squadrons of intermediary brokers.

So, yes, I most assuredly believe that there is a very strong relationship between round-lot trades and millionaires. It's just not a relationship I can prove.