Online auction prices

Every morning I record prices for railroad stocks and bonds that sold on eBay-US for more than $25 the day before.

Sometime later, I enter serial numbers and prices into the database. The database allows me to track maximum and minimum prices paid from all sources. As expected, most sales occur between previously recorded highs and lows. Rarely do eBay sales establish new high prices.

In fact, most eBay sales take place well below median prices. I estimate about 5% of eBay sales either tie previous minimums or establish new lows.

This points out something you should know about price behavior of scarce and rare stocks and bonds on eBay. For scripophily, eBay is a "buyer's market." That means buyers have an advantage over sellers. They control prices.

Generally speaking, prices rise when there are many buyers and few sellers. Conversely, prices fall when there are few buyers and many sellers. This later condition seems to be the case for selling of collectible stocks and bonds in online auctions.

An increase of only 98 new varieties since June because of dupe removal

|

June

letter |

This

letter |

| Number of certificates listed (counting all variants of issued, specimens, etc.) |

20,317 |

20,417 |

| Number of distinct certificates known |

15,438 |

15,536 |

| Number of certificates with celebrity autographs |

1,497 |

1,505 |

| Number of celebrity autographs known |

326 |

326 |

| Number of railroads and railroad-related companies known |

25,080 |

25,090 |

| Number of companies for which at least one certificate is known |

6,601 |

6,596 |

| Serial numbers records |

68,893 |

70,325 |

Several professional dealers have lamented to me that online auctions have depressed prices in the collectible stock and bond market. Are they correct?

It is hard to be conclusive because I only look at railroad certificates. I cannot comment on the wider market that includes banking, utilities, oil, and mining issues.

However, it only takes a short history of prices to discover that scarce and rare items routinely attract low prices on eBay. Table 1 illustrates this point.

Table 1 shows all auction prices I currently have recorded for bonds from the Yosemite Short Line Railway Co. (Fixed prices from catalogs and web sites not included for this example.)

With one exception, eBay prices have proven lower than other auction prices of similar vintage. I assure you that similar patterns are found across hundreds of companies. We can discuss reasons forever, but it seems clear to me that eBay is a buyer's market as far as collectible railroad stocks and bonds are concerned.

Price behavior suggests—and numbers of bids per item confirm—that the eBay collectible stock and bond market is thin. While there are many participants overall, most items attract few bidders. Successful sellers establish low starting bids to attract bidding.

Another hallmark of thin markets is price unpredictability. Thin markets usually show large price ranges.

Table 1—Auction prices recorded for bonds from the Yosemite Short Line Railway

| Type of sale |

Year sold |

Sold for |

| American live auction |

1986 |

$33 |

| American mail bid auction |

1992 |

$68 |

| American live auction |

1992 |

$72 |

| American mail bid auction |

1993 |

$95 |

| American mail bid auction |

1994 |

$39 |

| American mail bid auction |

1994 |

$77 |

| American mail bid auction |

1997 |

$154 |

| American mail bid auction |

1998 |

$150 |

| German live auction |

2000 |

$140 |

| American mail bid auction |

2000 |

$138 |

| American mail bid auction |

2000 |

$92 |

| American mail bid auction |

2000 |

$138 |

| German live auction |

2001 |

$126 |

| eBay auction |

2002 |

$180 |

| American live auction |

2002 |

$83 |

| American live auction |

2003 |

$92 |

| eBay auction |

2003 |

$32 |

| American mail bid auction |

2003 |

$99 |

| American mail bid auction |

2004 |

$104 |

| American live auction |

2005 |

$82 |

| eBay auction |

2005 |

$67 |

| eBay auction |

2005 |

$61 |

| eBay auction |

2005 |

$32 |

| eBay auction |

2005 |

$65 |

Table 1 confirms a wide range in sales prices, but these bonds are not rare. Serial numbers suggest a few thousand bonds may exist. Let’s look at how a very rare certificate behaves in an eBay auction.

So far, only two certificates from the Cleveland Zanesville & Cincinnati Railroad are known to me. Both sold on eBay. The first example sold for $231 in 2001. Another appeared in 2005, It sold for only $37. Obviously, very few people noticed the second appearance. I don’t think a price estimate of $400 is unreasonable had this item sold in a well-attended live auction.

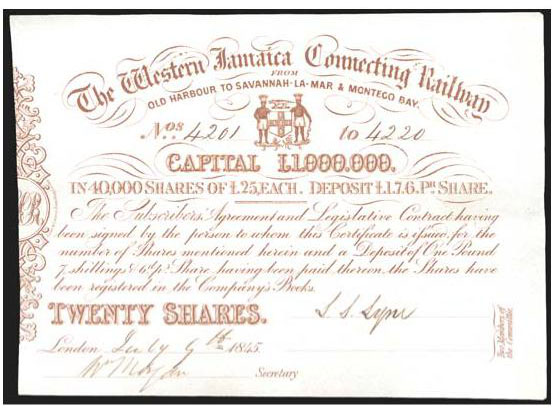

A plain, but seemingly scarce British-issued certificate from The Western Jamaica Connecting Railway, 1845.

A plain, but seemingly scarce British-issued certificate from The Western Jamaica Connecting Railway, 1845.

Let’s now look at an item of unknown rarity. Table 2 shows sales for a stock certificate from the Oregon Electric Railway. This is a new item cycling through eBay. I became aware of this certificate in early July and seven have sold so far, all on eBay. I have no earthly idea how many more may exist.

Notice the wide and unpredictable price swings in Table 2.

This kind of price behavior makes for challenging estimation when publishing a price guide. It is also creates great opportunities for astute collectors and observant dealers. It is no accident that dealers who know their markets are regular bidders on eBay. They need to sift through large numbers of low-priced certificates, but there are great opportunities to acquire scarcities at great prices.

Notice that I have talked about the price behavior of scarcer and more desirable certificates. I don’t mean to dismiss common items. I simply do not have the time to track their sales.

Table 2—Auction prices for Oregon Electric Railway stock certificates

currently selling on eBay.

| Certificate date |

Approx date sold |

Sold for |

| 1910 |

Jul 12, 2005 |

$68 |

| 1914 |

Jul 29, 2005 |

$51 |

| 1911 |

July 30, 2005 |

$100 |

| 1922 |

Aug7, 2005 |

$37 |

| 1912 |

Aug 16, 2005 |

$38 |

| 1924 |

Aug 29, 2005 |

$79 |

| 1944 |

Sep 8, 2005 |

$68 |

However, I routinely notice some common items sell on eBay for more than everyday fixed prices from scripophily dealers. I suspect this paradoxical phenomenon indicates more about collector inexperience than about the health of the hobby.

But back to the comments from dealers about the effect of online auctions on overall prices. Personally, I think they are correct! I think prices are being depressed. And I think this downward pressure will continue here in the U.S. However, I expect to see even stronger long-term effects in Europe where prices for U.S. rail issues are substantially higher than in North America.

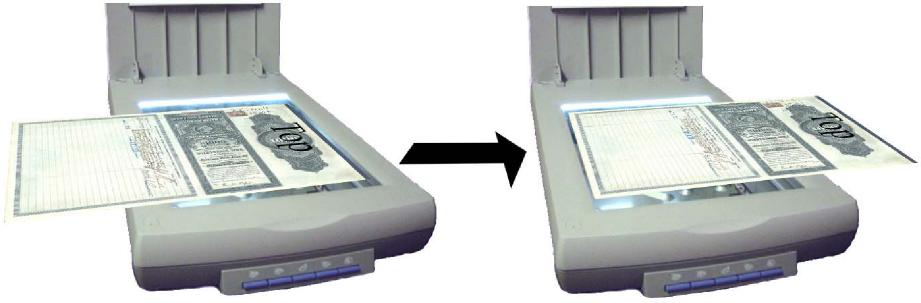

Scanning in pieces

Collectors often send me higher-resolution scans of their certificates. Large certificates exceed the size of their scanners, so they scan certificates in two pieces. Normally, it only takes me a couple minutes to patch the pieces back together and thereby acquire good, complete images of large certificates.

Everything works fine when the both pieces are scanned with the same orientation (with the top facing the same direction.)

Problems arise when the orientation changes. Changing orientation makes the scanner light hit the certificate surface at different angles. A few degrees of change does not matter much, but widely different light angles causes different exposures and different color tints.

I can adjust coloration and exposure, but I don’t have the time to re-construct usable images when two-piece scans are flipped. If scanning large certificates in pieces, whether for my use or yours, be sure to keep the orientation the same.

Scan large certificates in pieces on an 8½x11 scanner . . . like this,

. . . NOT like this.

Cycles in the hobby

Having recorded railroad certificates almost every day for ten or twelve years, I have the luxury of feeling and seeing cycles. Some are obvious, such as the weekly peak of eBay sales on Saturday and Sunday.

Most cycles are less obvious and become apparent only in hindsight. Right now, we are seeing a heavy influx of specimens, both in fixed price lists and auctions. Considering scarcity, specimen prices are exceedingly attractive.

2003 and 2004 displayed an intriguing cycle of new certificate discovery. That cycle came on the heels of the Northern Pacific hoard. While new certificates continue to appear in 2005, numbers seem substantially down. In fact, the numbers of new types would be quite low were it not for the appearance of so many new specimens.