Rarity as a sales tool

I think it is fascinating to watch how sellers make sales pitches for collectibles. I’m talking about the pitches for both real

collectibles (coins, stamps, and certificates) and manufactured collectibles (dolls, plates, and sculptures you see for sale in magazines.)

I find their attempts at selling collectibles on the basis of rarity sadly off the mark. Rarity — and especially the vacuous promise of future rarity — is not how most serious collectors buy.

I know I am overly simplistic. But, I really think my correspondents buy certificates primarily because they want them. Not because they are rare. I am not saying they don’t buy rare certificates. I am saying their motivations are personal and separate from rarity.

I think the major thing that drives collecting is desirability. Yes, rarity affects desirability. But for intermediate and advanced collectors, dealers can not make things desirable just by saying that things are rare. It doesn’t work that way.

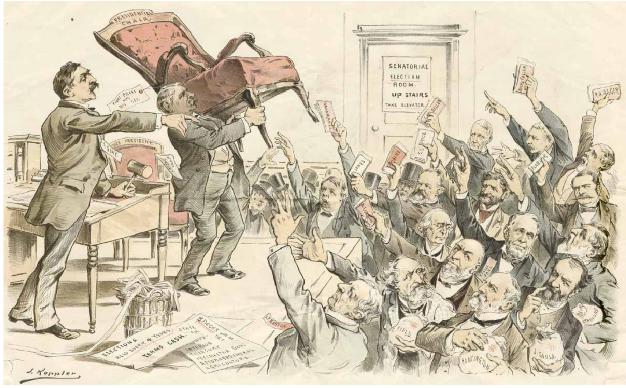

“AMERICAN POLITICS HAVE NEVER BEEN THIS BAD BEFORE.” Yeah, right!!! Here we see a colored lithograph from the March 12, 1890 Puck magazine. The caption reads “None but millionaires need apply—the coming style of presidential election.” At auction, of course, is the seat of the presidency and eight matching cabinet positions. Bidding for Interior, Treasury, and Attorney General positions are prominent millionaires, including major railroad personalities such as Jay Gould, Leland Stanford, Collis Huntington, Russell Sage, Sidney Dillon, and Henry Flagler. Holding his hand the highest is John D. Rockefeller.

“AMERICAN POLITICS HAVE NEVER BEEN THIS BAD BEFORE.” Yeah, right!!! Here we see a colored lithograph from the March 12, 1890 Puck magazine. The caption reads “None but millionaires need apply—the coming style of presidential election.” At auction, of course, is the seat of the presidency and eight matching cabinet positions. Bidding for Interior, Treasury, and Attorney General positions are prominent millionaires, including major railroad personalities such as Jay Gould, Leland Stanford, Collis Huntington, Russell Sage, Sidney Dillon, and Henry Flagler. Holding his hand the highest is John D. Rockefeller.

In fact, I could probably list hundreds of stocks and bonds that are quite rare, and yet, are not particularly desirable.

On the other hand, there are certificates like the Harrisburg Portsmouth Mount Joy & Lancaster Rail Road Co stock certificates. They are not particularly scarce. They are, however, highly desirable.

What you find desirable is different from every other collector. Every collector has differing views of the importance of appearance, company name, operating location, autographs, color, paper, denominations, historical importance, dates, condition, engravers, vignettes, and so forth.

Rarity affects desirability. But I strongly suggest that rarity is not the central factor in most people’s style of collecting.

Desirability is extremely personal. It is what makes the selling of collectibles so fascinating. I think every experienced collectibles dealer would admit that he or she does not really sell collectibles. Collectibles sell themselves.

Live auctions are probably the best places to see the concept of desirability played out. I don’t think it matters whether it is a high-powered Sotheby’s auction, or a crowded backyard estate sale. And I don’t think it matters whether the items are 1804 silver dollars or 1944 milk cans.

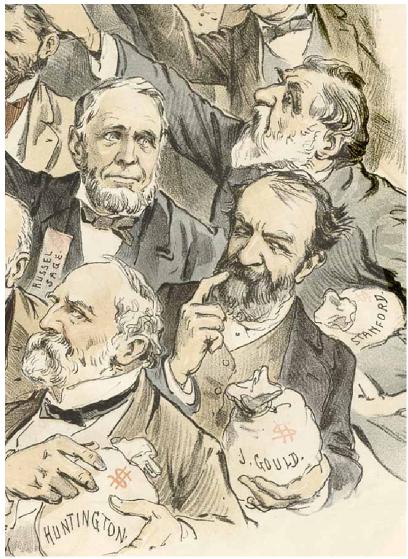

Close-up view of the Puck lithograph on page 1 showing (clockwise) Sage, Stanford, Gould, and Huntington.

Close-up view of the Puck lithograph on page 1 showing (clockwise) Sage, Stanford, Gould, and Huntington.

Rarity is never the central issue when two or more people desire the same item. The stronger their desires, the stronger the prices. But there must be two, or more, desirous buyers.

You will often find dealers playing the role of a desirous party. There are many dealers who want to own collectibles more than their buyers. When that happens, items go unsold for months or years.

There are three main concepts to understanding the relevance of rarity in collecting.

- Rarity does NOT equal desirability.

- Rarity does NOT equal price.

- The world is FULL of rarities.

When you combine desirability and rarity, you get expensive collectibles. Those are the kinds of items you see offered at major auction sales.

Currently, it is easy to buy rare stocks and bonds. Every single week, several one-of-a-kind items sell on the internet. And I am continually amazed at how cheaply some sell.

If those certificates are so rare, why are the prices so low? First, it takes business experience to attract desirous buyers. And secondly, many rarities are not particularly desirable.

427 New certificates since September

|

1st Edition |

2nd Edition |

Currently |

| Number of certificates listed (counting all variants of issued, specimens, etc.) |

8,559 |

14,112 |

15,651 |

| Number of distinct certificates known |

7,152 |

11,146 |

12,238 |

| Number of certificates with celebrity autographs |

699 |

1,175 |

1,240 |

| Number of celebrity autographs known |

232 |

342 |

346 |

| Number of railroads and railroad-related companies known |

17,276 |

19,805 |

23,009 |

| Number of companies for which at least one certificate is known |

3,516 |

5,001 |

5,478 |

Holabird to Sell Garbani Arizona Collection

James Garbani was a helpful contributor to my early cataloging efforts. He is a big collector of Arizona certificates, particularly mining certificates. He is selling his large collection through Fred Holabird in February, and it includes several scarce Arizona railroads. Contact Fred Holabird online at www.holabird.org or by mail at 355 Airway Dr #308, Reno NV 89511.

Thanks to collectors who solved mysteries in the last newsletter

In the last newsletter, I listed 137 mysterious stock certificates that had appeared in non-illustrated auction lots with little or no description. I am not even 100% certain that all are stock certificates. So far, collectors have helped solve 33 of those mysteries. I appreciate everyone’s contributions. I give special thanks to dealer Sam Withers (PO Box 19916, St Louis MO 63144). He really got into the challenge and sent copies of about 25 of those elusive certificates.

Common vs Capital

When I first started cataloging stock certificates, I decided to group them in two categories and label them as either common or preferred. Over the years, I have received many inquiries asking to explain the differences between common and capital stocks. Recently, I corrected the entire database to better represent what the text on stock certificates actually says. While I examined photos and copies of several thousand items, I am positive that errors still exist. If you use my online database, and discover errors, please let me know.

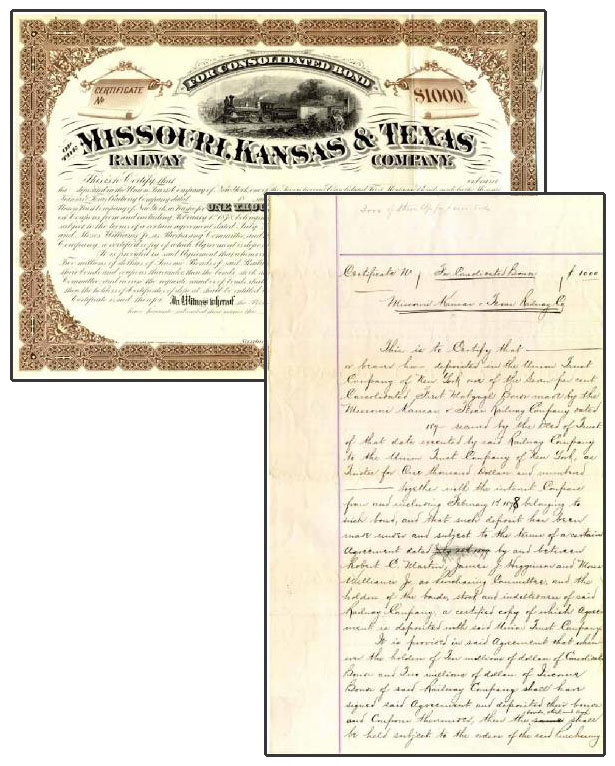

While I once called this a “bond” for the sake of cataloging, it is actually a certificate of deposit for consolidated first mortgage bonds deposited with a purchasing committee. I assume this was an attempt to direct the fate of the company while in receivership. The text was engraved by American Bank Note company from the handwritten text at right. The certificate shown is a proof. I do not currently know of any issued examples.

While I once called this a “bond” for the sake of cataloging, it is actually a certificate of deposit for consolidated first mortgage bonds deposited with a purchasing committee. I assume this was an attempt to direct the fate of the company while in receivership. The text was engraved by American Bank Note company from the handwritten text at right. The certificate shown is a proof. I do not currently know of any issued examples.

Speaking of errors

The online database now lists over 15,000 certificates and over 21,000 companies. That means I have created more than a million opportunities for spelling errors, alone. The opportunities for errors in data and compilation adds more possibilities for mistakes. Trust me, finding mistakes is not hard. But it is impossible to find them all. I beg you to tell me of any errors you find, whether in the original book, or online.

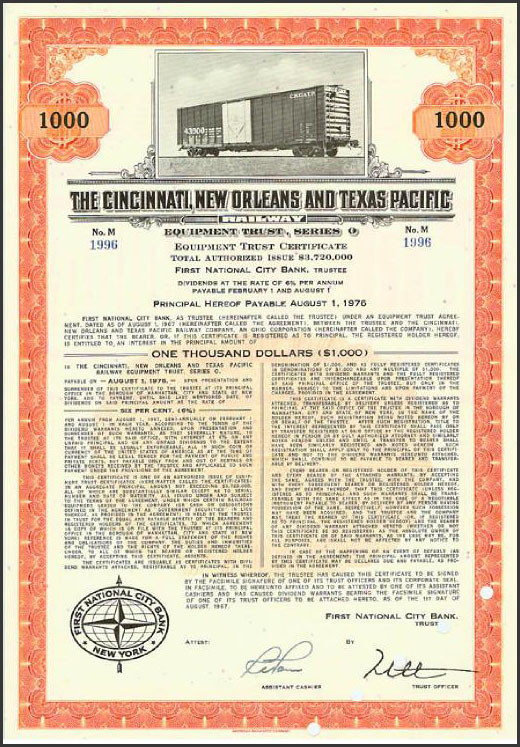

Trust certificate for The Cincinnati New Orleans & Texas Pacific Railway. Series O. Due August, 1976. Do you have more varieties?

Trust certificate for The Cincinnati New Orleans & Texas Pacific Railway. Series O. Due August, 1976. Do you have more varieties?

Are You Missing the September Newsletter?

At least one of my newsletters never made it to Europe following the September 11th attacks. Please tell me if you never received the last issue and I will send you another.

State Corporation Listings

In the last couple months, I have added 2,700 company names that I found among state corporation databases. Fortunately, most states now have their databases of corporations online.

Unfortunately, the quality of information available from some states is terrible. Misspellings are the rule. Incorporation dates seldom agree with corporate sources. Some states only allow users to search by the first words of company names. (If a state clerk has misspelled that first word, you are out of luck!) So far, I have found the best databases are those for the states of Ohio, New York, Arkansas, and Wyoming. A few states are downright pathetic with no quality control or user friendliness whatsoever!

My point in bringing this up is to remind you to search state databases if you are researching specific companies. If you are lucky to find a good state database, you will unearth a wealth of details. In fact, I have found MANY companies listed in state corporation databases that I have never seen anywhere else. And some states really help to unravel multiple incorporations under the same name.

The trick to such searching is to first find the Secretary of State in your state of interest. Next look for a “corporations department.” Another trick is to search for a state name and the word “corporations.”

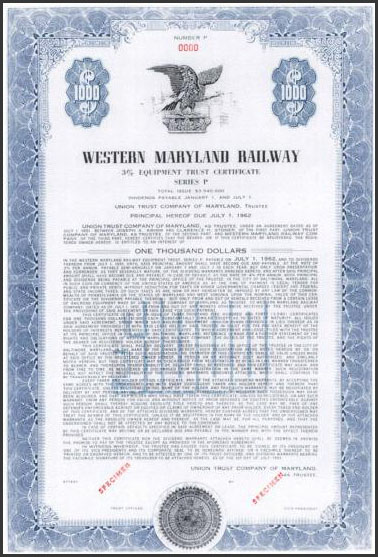

Equipment Trust Certificates Desperately Needed

If you have searched my online database, you will find that I separate trust certificates from ordinary stocks and bonds. I did that because equipment trusts, while benefiting specific railroad companies, were actually separate corporate entities.

For both taxing and financial reasons, equipment trusts became the major method for rolling stock ownership by the middle of the 20th century. The issues from equipment trusts were almost always very complicated with many varieties showing different redemption dates and interest/dividend rates.

In the last two years, contributors have enlarged the number of known varieties by probably a couple hundred. Yet, that number is only a drop in the bucket of the thousand or more varieties possible.

I don’t know whether that many certificates still exist. If you have any equipment trust certificates, would you send me 81/2 x 11 copies? If you have multiples, please look at them carefully. Many varieties differ only by very small interest rate or redemption date changes. You even need to check the months of redemption.

The upshot is that I have barely even scratched the surface in listing equipment trust certificates. Can you help? Please, don’t worry about sending too many.